Using Home Equity for Renovations: What to Know

Over at Cameron Construction, we see a ton of folks chomping at the bit to jazz up their cribs. And here’s the kicker—how do you tap into that home equity without setting your wallet on fire?

Home equity, my friends, is like a double-edged sword. Sure, it can bankroll your home makeovers, but there’s homework to do (and thumbtacks to mind).

So, let’s break it down. We’re diving into the nitty-gritty of leveraging your home’s equity for those reno dreams. The goal? Equip you with the know-how to make a savvy decision about financing this venture.

What Is Home Equity and How Do You Calculate It?

Understanding Home Equity

Home equity-sounds fancy, right? It’s basically the gap between what your house is worth right now and what you still owe on it. Kind of like when your buddy owes you 20 bucks but you know he’s good for it. This financial wizardry can bankroll your big kitchen dreams, but you better know the gears and gizmos before diving in.

Factors Influencing Your Home Equity

So, what messes with your home equity?

- Property’s Market Value: It’s a moody beast, swayed by local real estate vibes, the economy, and whatever TLC you’ve given your place. Check this-23.7% jump in Aussie home prices over just a year? Makes everyone feel a little richer…or not if you’re buying.

- Mortgage Balance: The less you owe, the more you own-simple math. Throwing extra cash or a windfall at it? Boosts your equity faster than you can say “home sweet home.”

- Initial Down Payment: Remember that first big chunk you handed over to seal the deal? Yeah, that was your welcome mat into home equity.

Calculating Your Available Equity

Wanna know what you’ve got to play with? Do this:

- Estimate your pad’s worth (get a pro or peek at nearby deals).

- Knock off what you owe on the mortgage.

For example:

- Home value: $500,000

- Mortgage balance: $300,000

- Total equity: $200,000

Lenders usually let you nab up to 80% of your home’s value, then subtract your mortgage. In this case, you’ve got $100,000 you can potentially use (80% of $500,000 = $400,000, minus $300,000 mortgage).

Leveraging Equity for Renovations

Thinking about giving your place a facelift with that equity? Hold up. Consider how much bang you’ll get for your buck. Kitchens and bathrooms-these bad boys usually pay off, no surprise according to the HIA Kitchens & Bathrooms Report 2022/23. People are nesting more, spending more.

Before you dive in, give your finances a once-over. You need to be able to handle the extra load without sweating bullets. Sure, using home equity can be a slick move for funding those HGTV dreams, but remember-more debt equals more risk on your castle if you fall behind on payments.

As you toy with the idea of using home equity for your dream projects, get cozy with your financing options. Let’s break them down so you can make the smartest move for those reno plans burning a hole in your pocket.

How to Tap Into Your Home Equity for Renovations

Home Equity Loans: The Lump Sum Approach

Think of home equity loans as a second mortgage – it’s like they hand you a bag of cash once you tap that sweet home equity. You get a lump sum, which is great for those big-ticket projects like revamping your kitchen or adding a whole new wing to your house. You’re looking at fixed interest rates here, so you know what you’re shelling out every month. (Just remember, your home is on the line as collateral, so you gotta weigh the rewards against the risks.)

Interest rates for outstanding mortgage borrowers have skyrocketed – think 320 basis points up between May 2022 and December 2023.

HELOCs: Flexible Funding for Ongoing Projects

A HELOC – Home Equity Line of Credit – is like having a financial safety net (up to a set limit). It’s your revolving door of cash, much like a credit card, but with your home in the mix. This move is your wingman for projects that might throw a curveball your way or just take their sweet time.

HELOCs come with variable interest rates (meaning you need to keep an eagle eye on those rates).

Cash-Out Refinancing: A Fresh Start

Cash-out refinancing – it’s a redo of your mortgage, but with a bit more punch. You swap your existing mortgage for a taller one, pocketing the difference. It’s genius if current interest rates are lower than what you signed up for originally.

Mortgage rates have tacked on about 320 basis points in this time period between May 2022 and December 2023. Watch out, though – closing costs can really thin out your renovation wallet.

Choosing the Right Option

The perfect fit depends on your unique circumstances. Dive into the math, consider your long-haul financial dreams, and let that guide you. A hefty $50,000 kitchen revamp? A home equity loan probably has you covered. Smaller, staggered projects? HELOC’s flexibility could be your new best friend.

Comparing Lenders and Terms

Shop around. Get quotes from multiple lenders. Check out those interest rates, look for hidden fees, and see what the whole shebang will cost you over time. Plus, a tip – project how much value that shiny upgrade is adding to your home. A savvy renovation can lift your property’s value, giving you more bang from your borrowed buck.

Line up these options against your renovation goals and financial compass. We’re gonna head into dissecting the pros and cons of using home equity next – to gear you up for a well-thought-out choice.

The Real Deal on Home Equity Renovations: Pros, Cons, and Smart Strategies

Lower Interest Rates and Tax Benefits

So, here’s the skinny-home equity loans? They’re usually rocking lower interest rates compared to those plastic-fantastic credit cards or personal loans. And that difference? It’s not trivial; we’re talking savings that can add up to thousands over the loan’s lifetime… Seriously. And hey, the interest you pay might even be tax-deductible (but hold your horses, folks, always chat with your accountant for the deets).

Boosting Property Value

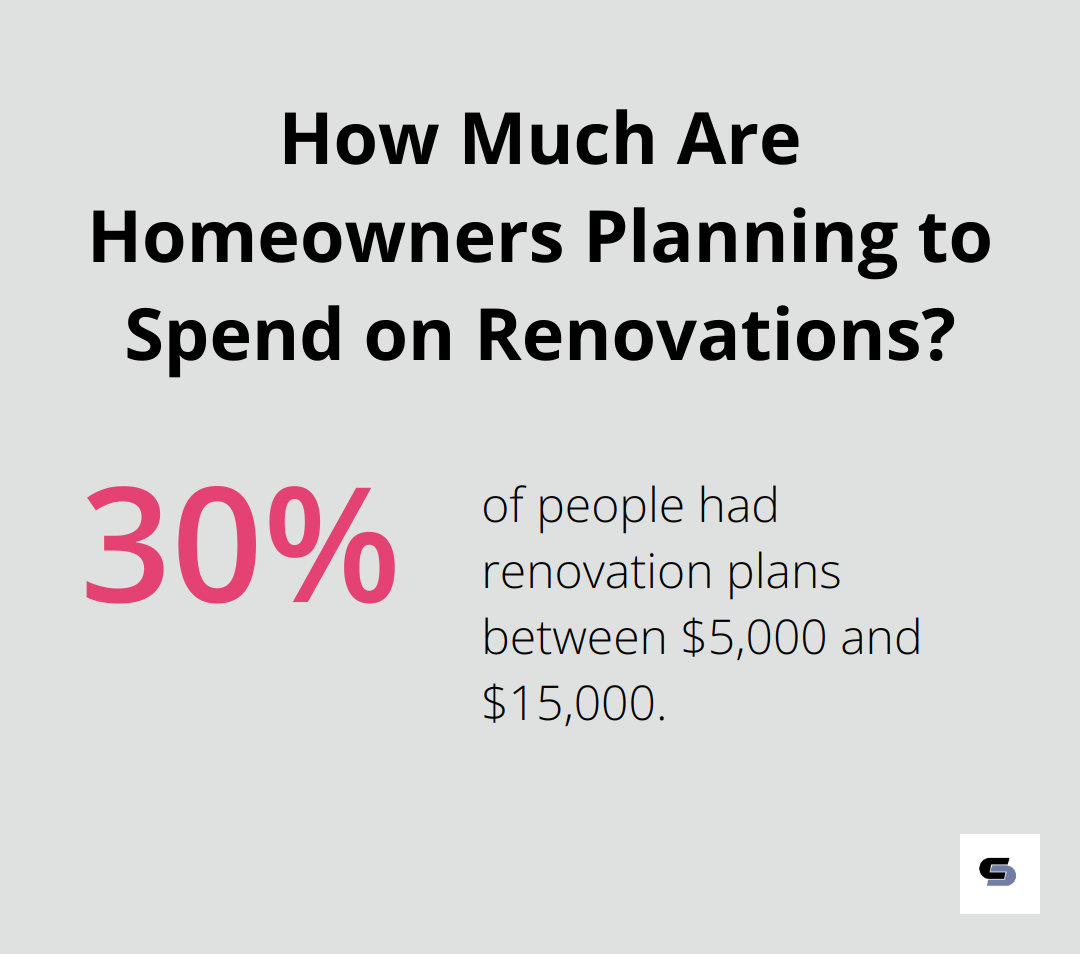

Pouring dollars into renovations can supercharge your home’s value. Boom. Check this out-over 30% of folks had plans between $5,000 and $15,000. And where’s that money going? Kitchens and bathrooms, baby, the two real MVPs of renovation nation.

The Risk of Using Your Home as Collateral

Alright, time for the cold splash of reality. The major downside of tapping into your home equity? Your house-yep, it’s the collateral. Miss those payments… and you could seriously risk losing your home. Don’t think it’s just some scare tactic. It’s happening. Back in 2023, Down Under, mortgage delinquency rates nudged up to 1.38% (shoutout to S&P Global Ratings for that little nugget).

Hidden Costs to Consider

Beneath the surface, you’ve got these sneaky “closing costs” ready to ambush you. We’re talking anywhere from 2% to 5% of the loan-on a $100,000 loan, that’s $2,000 to $5,000 right outta your pocket. Ouch.

Tailoring Financing to Your Project

Got big dreams-like a whole new floor? Then a home equity loan might be your jam. You get all the cash upfront, a wallet full of cash perfect for paying contractors and scoring bulk materials.

But if it’s smaller tweaks you’re after, a Home Equity Line of Credit (HELOC) might be more your speed. Take just what you need, when you need it. This flexibility is your new BFF, helping you dodge extra interest like a pro.

Avoiding the Overborrowing Trap

Just because $100,000 is on the table doesn’t mean you gotta swipe it all. Stick to borrowing what you can handle without losing sleep. Overborrowing is a minefield; it could lead to some serious money woes. Remember, your home is on the line-miss payments, and we’re talking foreclosure risks. And let’s face it, nobody’s looking to sign up for a lifetime of debt.

Final Thoughts

Home equity financing-well, it’s like having a secret weapon for sprucing up your digs. But hold on… don’t just dive in headfirst. You’ve gotta plan, budget… plan some more. Really put on your CFO hat and crunch those numbers. You better know why you’re taking on more debt-think future you, not just next week.

At Cameron Construction, we’re all about turning your home dreams into reality (without breaking the bank or your sanity). Our crew knows the renovation game inside out, and we’ll help you marry your vision with your wallet. With over 40 years of upgrading pad after pad in Melbourne, we’ve got this.

Tapping into home equity? Yeah, it can be a winning play if you’re smart about it. It might just be the ticket to revamping your space and bumping up your property’s worth. But remember, this isn’t something to take lightly-no sir. Do your homework and team up with the pros who know their stuff, and you’re on your way to crafting that dream home.