Using Home Equity for Renovations: Pros and Cons

At Cameron Construction, we often encounter homeowners considering using home equity for renovations. This financing option can be an attractive way to fund home improvements, but it’s not without risks.

In this post, we’ll explore the pros and cons of tapping into your home’s equity for renovation projects. We’ll help you understand the potential benefits and drawbacks, so you can make an informed decision about whether this approach is right for you.

What Is Home Equity and How Can You Use It?

Understanding Home Equity

Home equity represents a powerful financial tool for homeowners. It’s the difference between your home’s current market value and the outstanding balance on your mortgage. For instance, if your home is worth $500,000 and you owe $300,000 on your mortgage, you have $200,000 in home equity.

Factors Influencing Home Equity

Several elements affect your home equity:

- Market Value: Your home’s worth fluctuates based on local real estate trends, economic conditions, and property improvements.

- Mortgage Balance: As you pay down your mortgage, your equity increases.

The Federal Reserve reports that mortgage balances grew by $11 billion during the fourth quarter of 2024 and totaled $12.61 trillion at the end of December.

Accessing Home Equity for Renovations

Homeowners can tap into their home equity for renovation projects through three primary methods:

- Home Equity Loans: These lump-sum loans use your home as collateral and typically offer fixed interest rates and structured repayment terms. According to TD Bank’s survey, many homeowners look to renovate and some plan to sell by 2025.

- Home Equity Lines of Credit (HELOCs): HELOCs provide a revolving credit line that you can draw from as needed. They often have variable interest rates and more flexible repayment terms, making them ideal for ongoing projects or when renovation costs are uncertain.

- Cash-Out Refinancing: This option replaces your existing mortgage with a new, larger loan. You pocket the difference in cash, which can provide substantial funds for renovations. However, it resets your mortgage terms and may extend your repayment period.

Key Considerations Before Using Home Equity

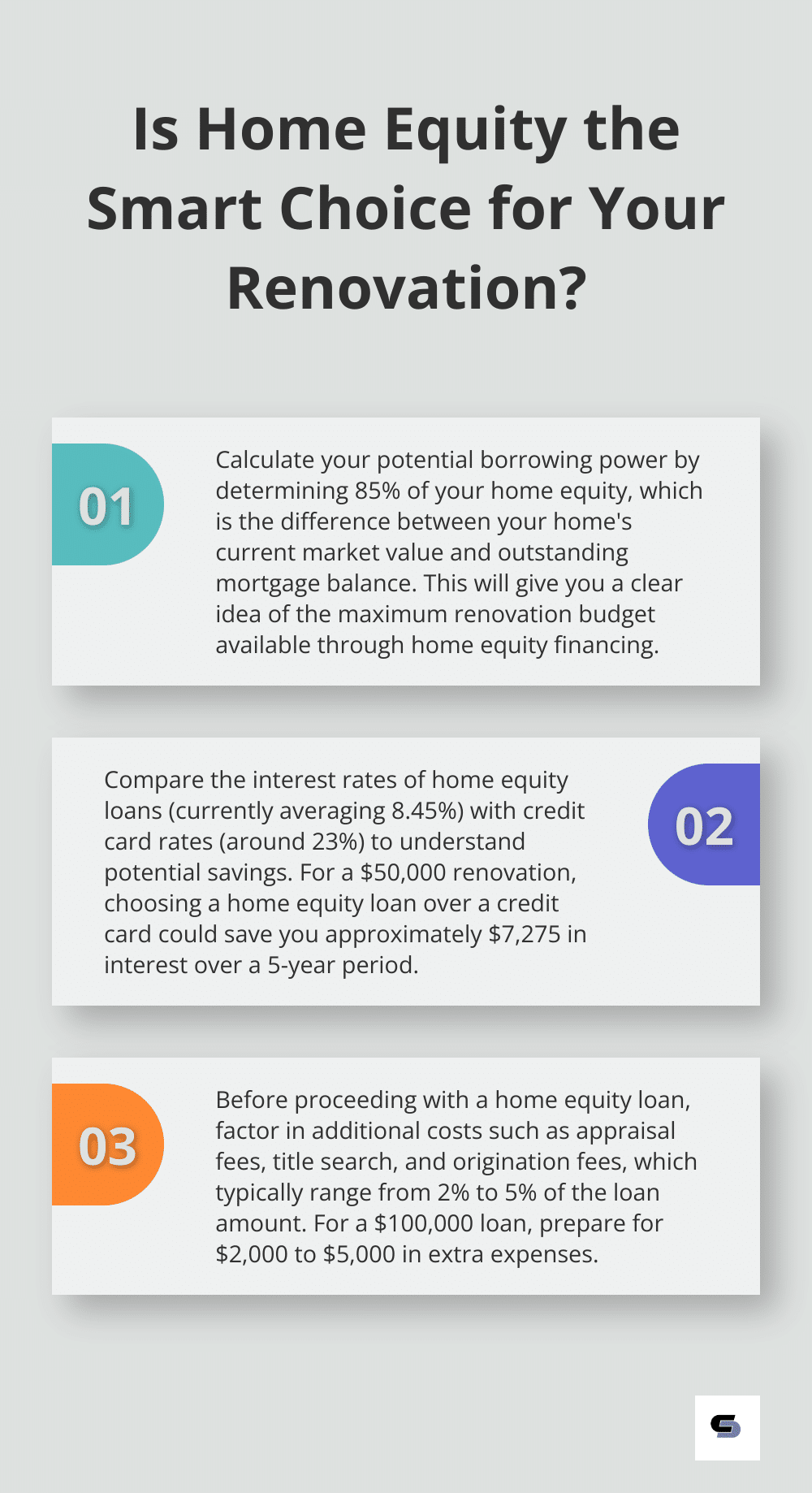

Before you access your home equity, assess your financial situation and renovation goals carefully. A professional appraisal will help you determine your home’s current value accurately, ensuring a realistic understanding of your available equity.

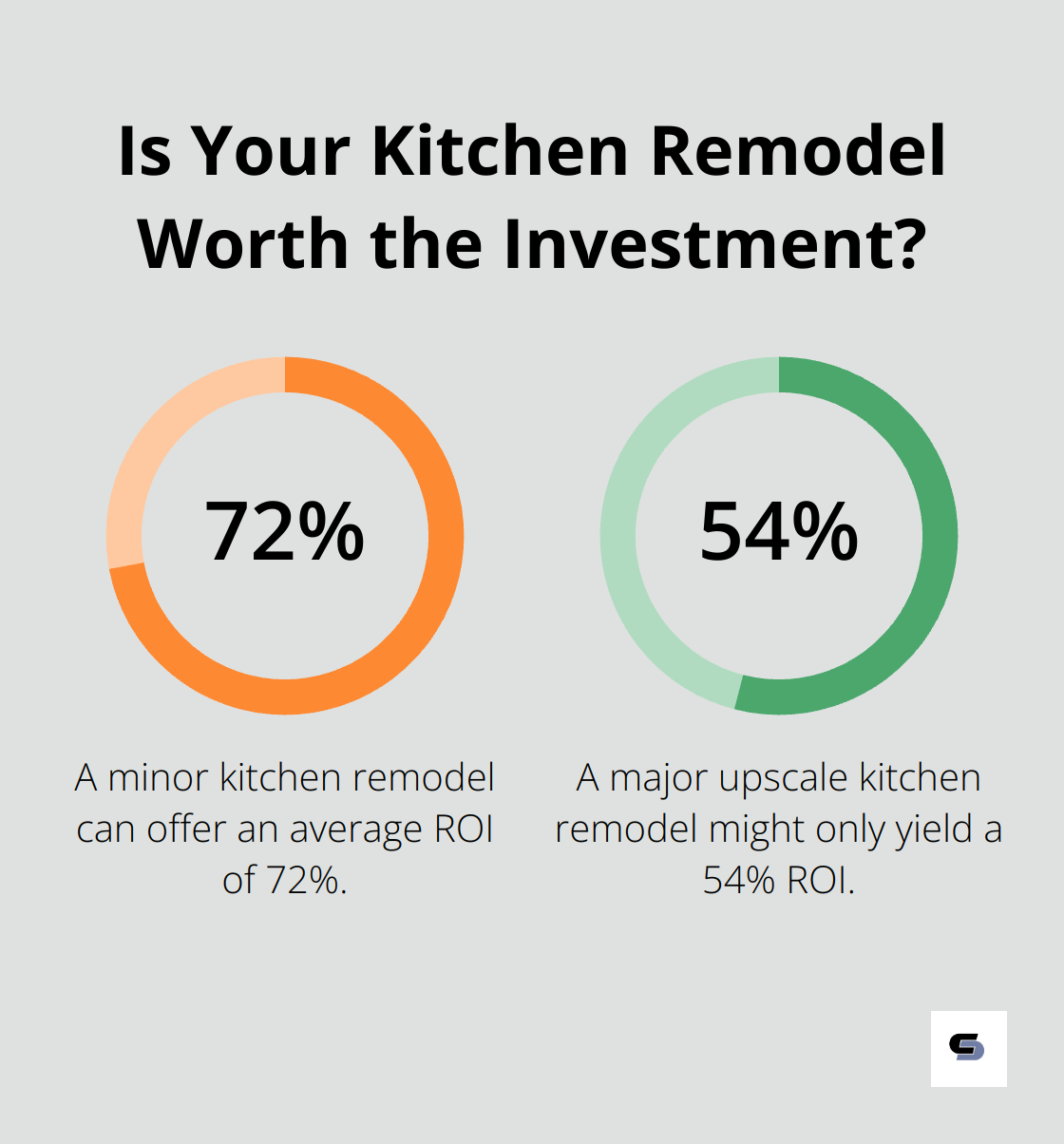

Consider the potential return on investment (ROI) for your planned renovations. Remodeling Magazine reports that certain projects yield higher returns than others. A minor kitchen remodel can offer an average ROI of 72%, while a major upscale kitchen remodel might only yield a 54% ROI.

It’s crucial to understand the risks involved. Using home equity means putting your home up as collateral, which could lead to foreclosure if you can’t repay the loan. Always create a solid repayment plan before proceeding.

Now that we’ve explored what home equity is and how to access it, let’s examine the advantages of using this financial tool for your home’s value.

Why Home Equity Can Be a Smart Choice for Renovations

Lower Interest Rates: More Value for Your Money

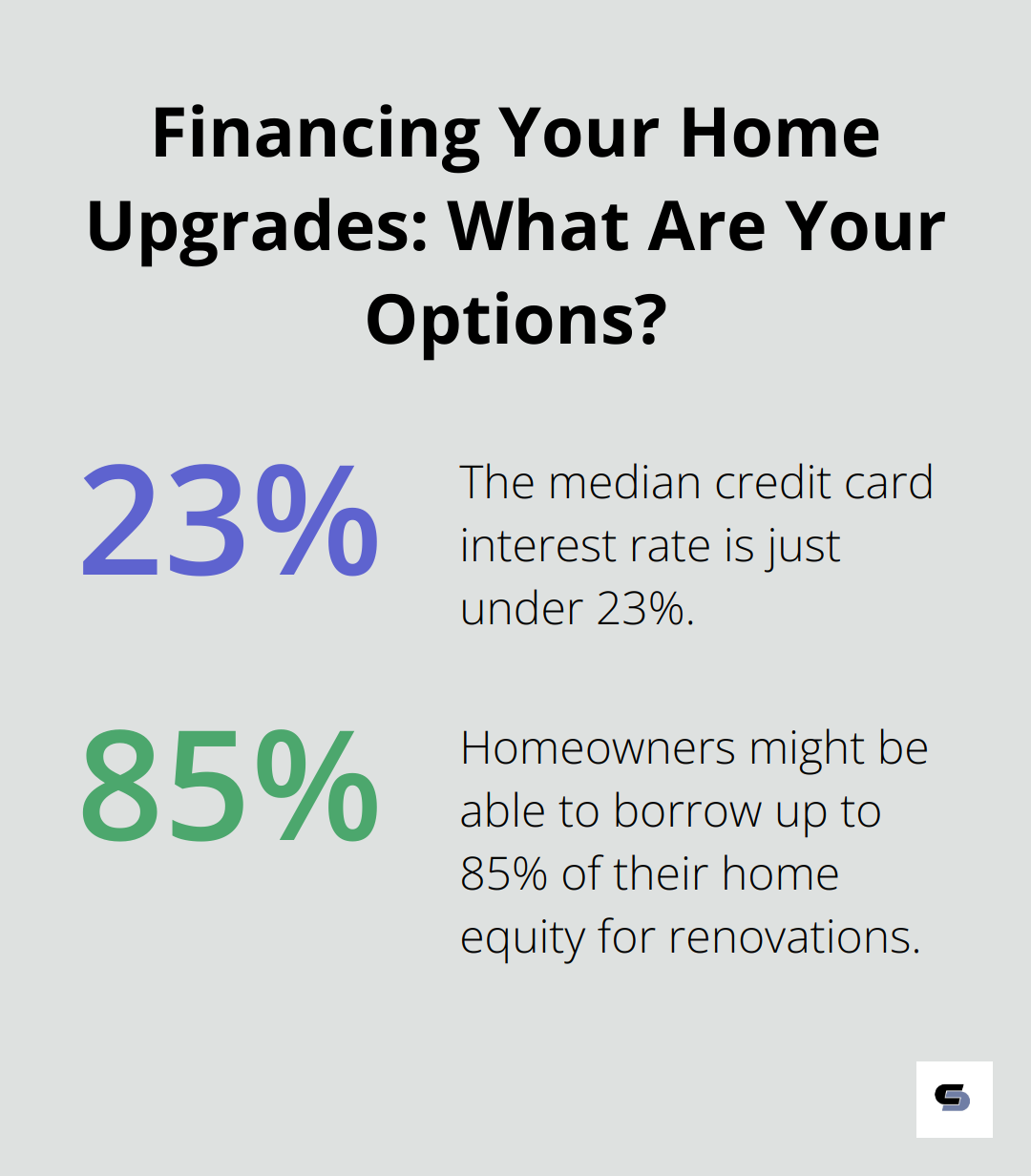

Home equity loans offer interest rates that are significantly lower than credit cards or personal loans. The average home equity loan interest rate is 8.45% currently while the median credit card interest rate is just under 23%. This difference can save you thousands of dollars over the life of your loan, allowing you to invest more in your renovation or keep more money in your pocket.

Increased Borrowing Power

One of the biggest advantages of using home equity is the ability to access larger sums of money. Depending on your home’s value and your outstanding mortgage balance, you might be able to borrow up to 85% of your equity. For a $500,000 home with a $300,000 mortgage balance, this could mean access to up to $125,000 for your renovation projects (subject to lender approval). This increased borrowing power allows for more comprehensive renovations that can significantly boost your home’s value and functionality.

Flexible Repayment Options

Home equity products often come with flexible repayment terms. HELOCs, for instance, typically have draw periods of 5-10 years, during which you can borrow as needed and make interest-only payments. This flexibility can be particularly useful for long-term or phased renovation projects. After the draw period, you enter a repayment period that can last up to 20 years, allowing you to spread out the cost of your renovations over a longer time frame.

Potential Tax Benefits

While tax laws can change, as of 2025, the interest paid on home equity loans and HELOCs used for home improvements may be tax-deductible. This potential tax benefit can further reduce the overall cost of your renovation project. However, it’s important to consult with a tax professional to understand how this might apply to your specific situation, as deductions are subject to limits and qualifications.

Improved Home Value and Functionality

Using home equity for renovations can lead to significant improvements in your home’s value and functionality. Your home equity percentage increases as you pay down your mortgage. It can also rise if the home’s worth increases, due to improvements you make. A well-executed renovation project (such as a kitchen remodel or bathroom upgrade) can increase your property’s market value, potentially offsetting a portion of your renovation costs when you decide to sell. Moreover, these improvements can enhance your daily living experience, making your home more comfortable and tailored to your needs.

While home equity can offer numerous benefits for financing your renovation projects, it’s important to weigh these advantages against potential risks. In the next section, we’ll explore some of the drawbacks and considerations you should keep in mind before tapping into your home’s equity.

The Hidden Costs of Home Equity Loans

Foreclosure Risk: Your Home on the Line

When you use your home as collateral, you put your most valuable asset at risk. If you fail to keep up with payments, you could lose your home. In February 2024, one in every 4,279 housing units had a foreclosure filing. This risk is real and should not be underestimated.

Fees: A Significant Addition to Your Costs

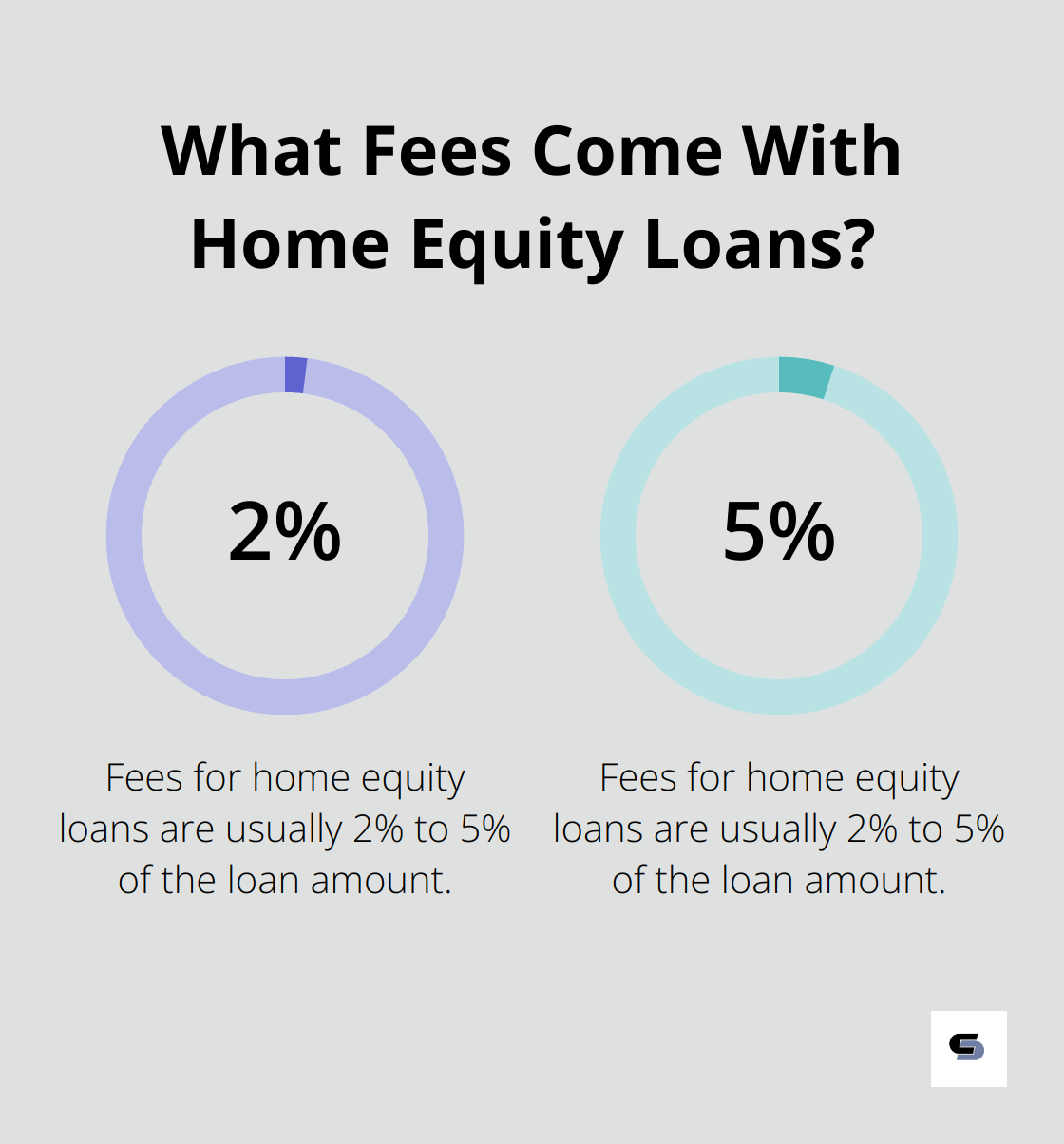

Home equity loans typically have higher APRs than mortgages, but they may have lower fees. Fees are usually 2% to 5% of your loan amount. These costs include appraisal fees, title search, and origination fees. Some lenders also charge annual fees for HELOCs (typically $50 to $100 per year).

Market Volatility: The Threat of Negative Equity

The housing market can be unpredictable. If property values decline, you might end up owing more than your home is worth. This scenario (known as negative equity) can limit your financial flexibility and make it difficult to sell or refinance your home.

Long-Term Financial Commitment: Years of Additional Debt

Taking out a home equity loan means committing to years of additional debt. Most home equity loans have terms between 5 and 30 years. This extended repayment period can impact your monthly budget and long-term financial goals. You should consider how this debt will affect your retirement plans or ability to save for other important life events.

Alternative Financing Options: Exploring Other Avenues

Before deciding to use home equity for renovations, you should explore alternative financing options. Personal loans, credit cards with promotional rates, or saving up for your project might be more suitable depending on your financial situation. Each option has its own set of pros and cons, and what works best will depend on your individual circumstances.

Final Thoughts

Using home equity for renovations offers lower interest rates and increased borrowing power, but it comes with risks such as foreclosure and additional fees. You must assess your financial situation, renovation goals, and long-term plans before tapping into your home’s equity. Consider alternative financing options and weigh them against the benefits and drawbacks of using home equity.

We recommend you consult with financial advisors and renovation experts to make an informed decision about using home equity for renovations. At Cameron Construction, our team of designers, engineers, and interior advisors can help you plan and execute your renovation project. We specialize in home renovations and extensions in Melbourne, with over 40 years of experience.

The decision to use home equity for renovations should be based on a thorough understanding of the pros and cons, your financial stability, and your long-term goals. You can make a choice that enhances your home and supports your financial well-being by carefully considering all aspects and seeking professional advice. Our commitment lies in delivering high-quality craftsmanship and increasing your property’s value, all while working within your financial parameters.