Is Bathroom Remodeling Covered by Home Insurance?

At Cameron Construction, we often encounter homeowners wondering: Does home insurance cover bathroom remodel projects?

This question is crucial for anyone planning to update their bathroom, as unexpected issues can arise during renovations.

In this post, we’ll explore the ins and outs of home insurance coverage for bathroom remodeling, helping you understand when you’re protected and when you might need additional coverage.

What Does Home Insurance Cover?

Standard Home Insurance Policies

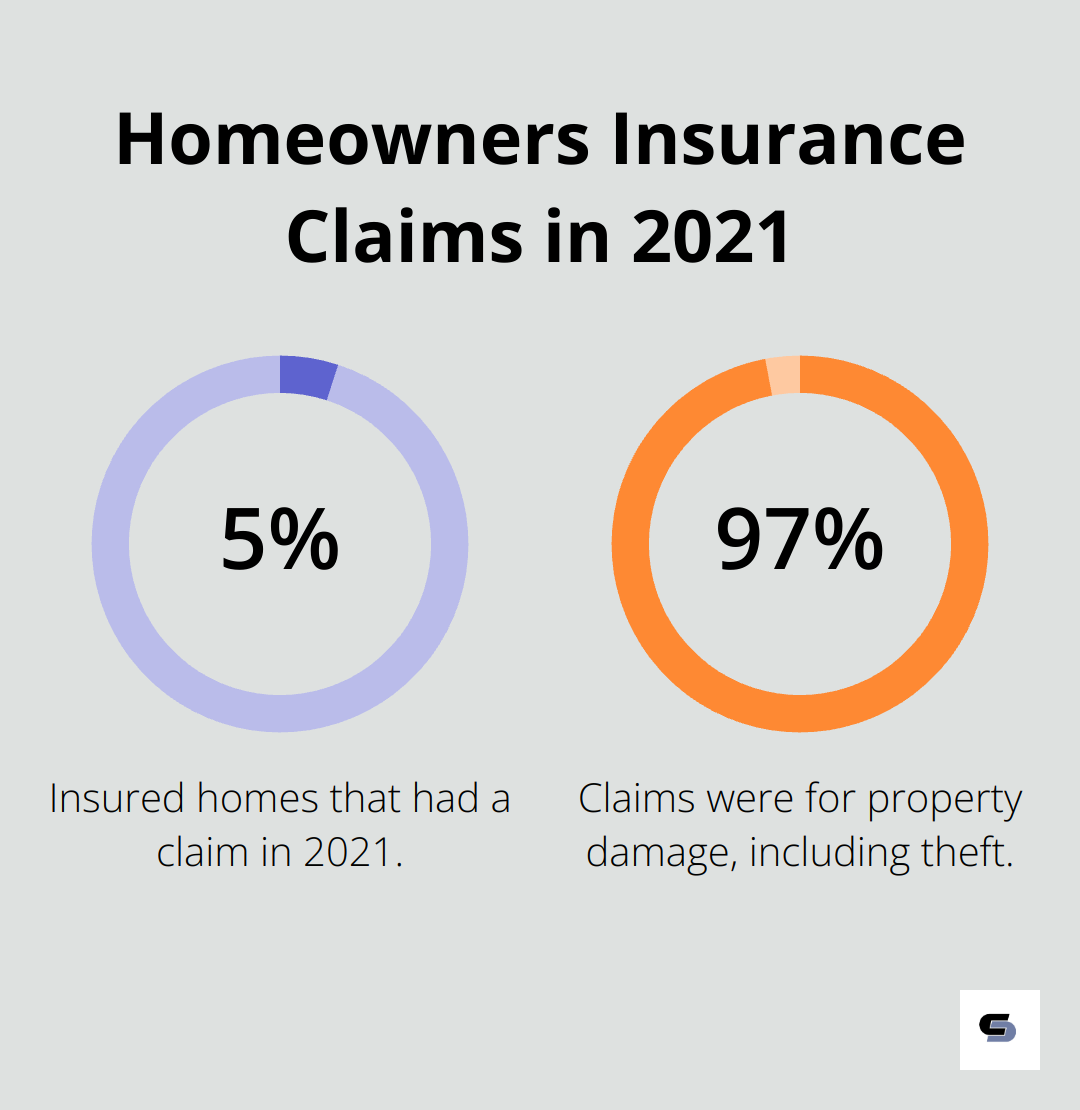

Home insurance is a complex topic, especially when it comes to bathroom remodeling. Most home insurance policies cover damage from unexpected events like fires, storms, or burglaries. However, they typically don’t cover normal wear and tear or voluntary renovations. According to ISO, in 2021, 5.3 percent of insured homes had a claim, with property damage, including theft, accounting for 97.8 percent of homeowners insurance claims.

Coverage for Bathroom Remodeling

When it comes to bathroom remodeling, home insurance usually doesn’t cover planned renovations. However, it may cover accidental damage that occurs during the renovation process. For example, if a pipe bursts during your remodel and causes water damage, your insurance might cover the repairs.

Policy Limitations and Exclusions

It’s important to understand your policy’s limitations. Many policies have a cap on how much they’ll pay for specific types of damage. For instance, water damage from a burst pipe might be limited to $5,000 (even if the actual damage is more extensive).

Some common exclusions in home insurance policies include:

- Flood damage (requires separate flood insurance)

- Earthquake damage (requires separate earthquake insurance)

- Mold (often excluded or severely limited)

- Poor workmanship or faulty materials

Reviewing Your Policy

You should review your policy carefully and consider additional coverage if needed. We recommend discussing your renovation plans with your insurance provider before starting any work. This can help you understand your coverage and identify any gaps that need addressing.

The Importance of Quality Workmanship

While home insurance is essential, it’s not a substitute for hiring reputable contractors. Ensuring proper insurance coverage for your contractor is crucial in protecting yourself and your property during renovations. This is where companies like Cameron Construction shine, as their expertise can significantly reduce the risk of problems during and after renovations.

As we move forward, let’s explore the specific scenarios where bathroom remodeling might be covered by home insurance, and what you need to know to protect your investment.

When Home Insurance Covers Bathroom Remodeling

Accidental Damage During Renovation

Home insurance doesn’t typically cover planned bathroom renovations, but it might step in for specific scenarios. If an unexpected accident occurs during your bathroom remodel, your policy could cover the resulting damage. Accidental damage occurs during your bathroom remodel, and your Budget Direct-insured home and/or contents are covered for damage or loss due to violent winds, lightning, rain, hail and snow. The damage must be sudden and accidental, not due to poor workmanship or gradual wear and tear.

Weather-Related Incidents

Natural disasters and severe weather events can disrupt your home, including your bathroom renovation project. Any incident unrelated to the work being done, such as damage from a weather event, may still be covered depending on your policy. For example, if high winds blow off your roof (exposing your bathroom to rain damage), your policy could help cover the costs to fix both the roof and the water-damaged bathroom.

Theft and Vandalism Protection

During a bathroom remodel, your home might become more vulnerable to theft or vandalism. If someone breaks into your home and steals newly purchased bathroom fixtures or vandalizes your renovation work, your home insurance policy might cover the losses. It’s essential to keep detailed records of your purchases and inform your insurer about the ongoing renovations.

Policy Review and Additional Coverage

We recommend that you review your insurance policies before starting any renovation project. While reputable contractors take every precaution to ensure a smooth remodeling process, understanding your coverage can provide an extra layer of protection. Each insurance policy is different, so it’s best to consult with your insurance provider about the specifics of your coverage.

Some homeowners opt for additional coverage during major renovations. This extra protection can fill gaps in standard policies and provide peace of mind throughout the remodeling process. Talk to your insurance agent about options like builder’s risk insurance or increased dwelling coverage during your bathroom renovation.

Now that we’ve explored when home insurance might cover bathroom remodeling, let’s examine the situations where your policy likely won’t provide coverage.

When Home Insurance Won’t Cover Your Bathroom Remodel

Normal Wear and Tear

Home insurance policies exclude damage from normal wear and tear. This includes issues like peeling paint, cracked tiles, or worn-out fixtures. Most homeowners insurance policies may not cover water damage due to negligence or poor maintenance. If your bathroom remodel becomes necessary due to years of use, you will need to pay for it yourself.

Poor Workmanship and Substandard Materials

Insurance won’t cover poor craftsmanship or the use of substandard materials during a bathroom renovation. For example, if a contractor installs your shower incorrectly and it leads to water damage, your insurance won’t pay for repairs. This fact emphasizes the importance of hiring reputable professionals who are known for their quality workmanship and use of premium materials.

Planned Renovations and Upgrades

Standard home insurance coverage doesn’t include voluntary upgrades and renovations. Whether you plan to install a luxurious spa tub or expand your bathroom’s footprint, these planned improvements are your financial responsibility.

Protecting Your Investment

To safeguard your investment during a bathroom remodel, you should:

- Talk to your insurance provider before starting renovations to understand your coverage limits.

- Consider builder’s risk insurance for major renovations (this can provide coverage during the construction phase).

- Check that your contractors have their own liability and workers’ compensation insurance.

- Keep records of your renovation process, including before and after photos, receipts, and contracts.

Policy Reassessment Post-Renovation

While home insurance won’t cover your planned bathroom remodel, maintaining adequate coverage remains important. After you complete renovations, you should reassess your policy to ensure it reflects your home’s increased value. Extended replacement cost value coverage pays the cost to repair or replace the damaged or destroyed home, without a deduction for depreciation.

Final Thoughts

Home insurance policies do not typically cover planned bathroom remodels. However, they may provide protection for unexpected incidents during renovations. We recommend you review your insurance policy and discuss your renovation plans with your provider before starting any work. This will help you understand your coverage and identify potential gaps.

To protect your investment, document your project thoroughly and ensure your contractors have proper insurance. After completing your renovation, reassess your policy to reflect your home’s increased value. These steps will help safeguard your newly remodeled bathroom.

For a worry-free bathroom remodeling experience, partner with experienced professionals. Cameron Construction offers expert renovation services, ensuring high-quality craftsmanship and customer satisfaction. Our team of skilled designers and builders can transform your bathroom while adhering to the highest standards of workmanship.