How to Save for Home Renovations: Expert Tips

At Cameron Construction, we understand the excitement of planning home renovations. However, we also know that financing these projects can be challenging.

Learning how to save for home renovations is a crucial step in turning your dreams into reality. In this post, we’ll share expert tips to help you build your renovation fund and explore financing options to make your home improvement goals achievable.

What’s Your Renovation Budget?

Define Your Renovation Scope

The first step in your home improvement journey involves a clear assessment of your renovation goals and budget. Start by creating a detailed list of all the changes you want to make. Instead of broad statements like “update kitchen,” specify elements such as “replace countertops” or “install new cabinets.” This level of detail will help you prioritize and budget more effectively.

Research Renovation Costs

After outlining your project, investigate the associated costs. Expect to spend between $25,000 and $150,000 for a kitchen renovation in 2025. Bathroom renovations typically range from $15,000 to $30,000. These figures can fluctuate based on materials, labor, and project complexity (factors you’ll need to consider carefully).

Set Realistic Financial Targets

With a clear scope and cost estimates in hand, it’s time to establish your budget. We recommend adding a 10-20% buffer for unexpected expenses. This extra cushion can cover surprises like hidden structural issues or last-minute design changes (which are more common than you might think).

Create a Realistic Timeline

Your timeline directly impacts your budget. Rushed renovations often result in higher costs. The Australian Bureau of Statistics indicates that most home renovations take 3-6 months to complete. Large-scale projects can extend to a year or more. Include time for planning, permits, and potential delays when setting your timeline.

Consider Professional Guidance

While DIY can save money, professional guidance often proves invaluable. Experts can help you avoid costly mistakes and ensure your renovation aligns with local building codes. They can also provide insights into cost-effective alternatives that you might not have considered.

A well-planned renovation sets the foundation for a smooth home improvement project that adds value to your property and enhances your living space. As you move forward, you’ll need to explore effective saving strategies to turn your renovation dreams into reality.

Smart Saving Strategies for Your Renovation

At Cameron Construction, we’ve witnessed numerous homeowners successfully fund their projects through smart financial planning. Here are effective strategies to build your renovation savings:

High-Yield Savings Account

Open a dedicated high-yield savings account for your renovation fund. These accounts can offer interest rates up to 5.45% p.a. for bonus savings rates or up to 5.00% p.a. for ongoing high interest savings account offers.

Automate Your Savings

Set up automatic transfers from your main account to your renovation savings account. Ask your employer to send part of your pay directly to your savings account as soon as you’re paid. This is a great way to boost your savings consistently.

Trim Unnecessary Expenses

Review your monthly expenses and identify areas to cut back. The average Australian household spends about $2,200 per month on non-essential items (according to the Australian Bureau of Statistics). A 20% reduction could free up $440 per month for your renovation fund.

Income Boost

Take on additional work or start a side hustle to accelerate your savings. The gig economy in Australia is growing, with some platforms reporting that top performers can earn over $5,000 per month. An extra $500 per month could add $6,000 to your renovation fund in a year.

Declutter and Sell

Look around your home for items you no longer need. The second-hand market in Australia is booming, with online platforms reporting that the average household has about $5,300 worth of unwanted items. Selling these could significantly boost your renovation fund.

These strategies can accelerate your savings for home renovations. The key lies in consistency and commitment to your financial goals. As you build your savings, you’ll also want to explore various financing options to complement your efforts and potentially start your renovation sooner.

Financing Your Home Renovation

Home Equity: Unlock Your Property’s Value

Home equity loans and lines of credit offer popular choices for renovation financing. These options allow you to borrow against your home’s equity. In 2025, Australian homeowners can benefit from professional guidance to ensure they get the right loan suited to their needs. Sydney’s finance professionals and dependable mortgage brokers can provide assistance. Call (02) 9982 8014 for expert advice.

Refinancing: Reset Your Mortgage

Cash-out refinancing replaces your current mortgage with a new, larger loan, allowing you to pocket the difference. This option attracts homeowners when current interest rates fall below existing mortgage rates. Australian homeowners often save thousands over their loan’s life through refinancing. However, consider refinancing costs (typically $300 to $1,000) when evaluating this option.

Personal Loans and Credit Cards: Quick but Expensive

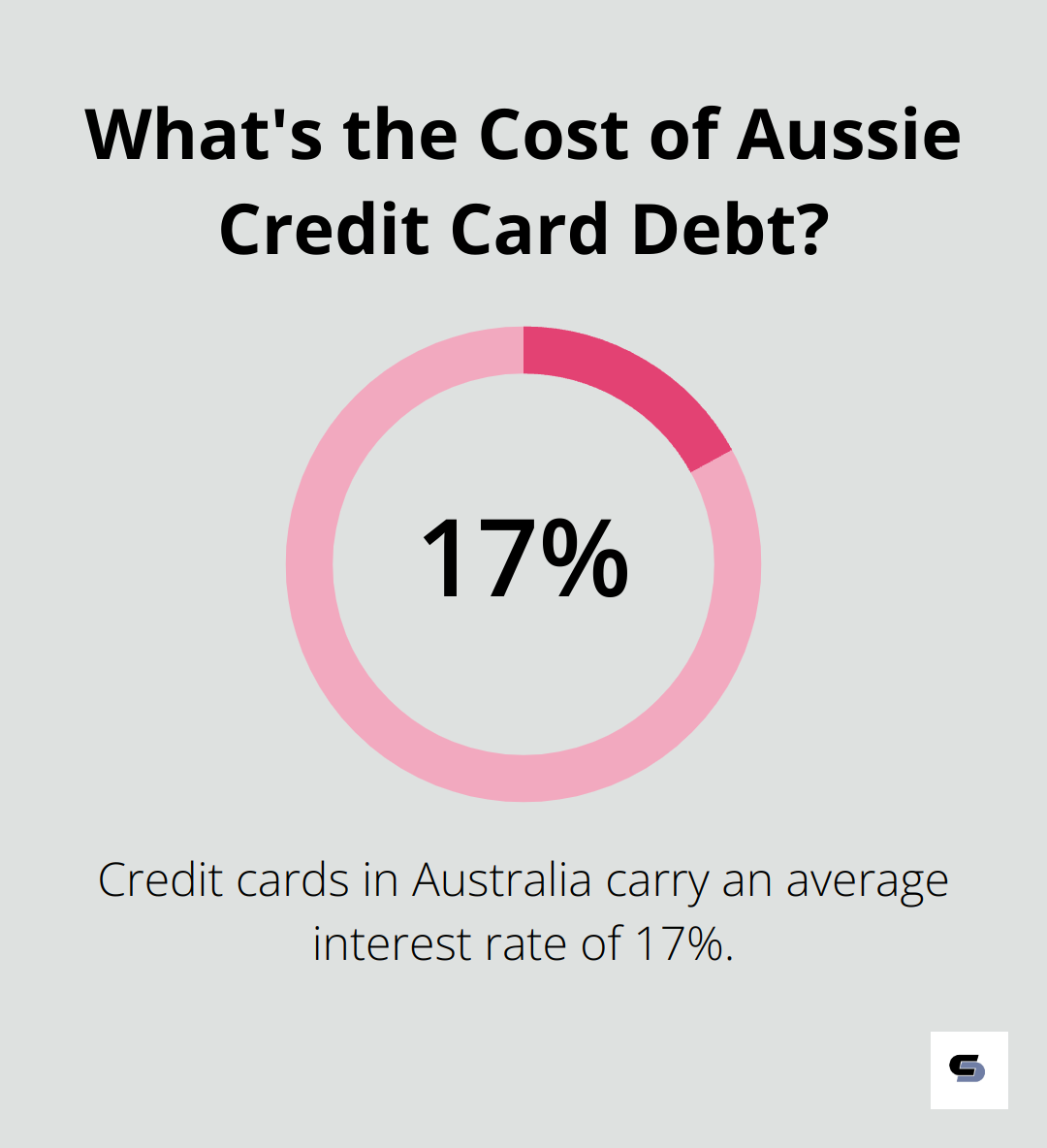

Smaller renovations might benefit from personal loans or credit cards. Personal loan interest rates in Australia range from 5% to 20%, depending on your credit score. Credit cards provide convenience but carry higher interest rates (averaging around 17%). Use these options cautiously and only for short-term financing needs.

Government Assistance: Eco-Friendly Incentives

The Australian government provides various grants and rebates for energy-efficient home improvements. The Small-scale Renewable Energy Scheme offers financial incentives for solar panel installations. As of November 21, 2024, it provides incentives to households and businesses to install small-scale renewable energy systems like rooftop solar, solar water heaters, and other eligible systems. Some states also provide rebates for energy-efficient appliances, which can offset kitchen or laundry renovation costs.

Combining Financing Options

Many homeowners successfully combine these financing options to fund their dream renovations. Assess each option’s terms, interest rates, and long-term financial impact carefully. A mix of savings and smart borrowing often creates the best strategy to achieve your desired home improvements.

Final Thoughts

Saving for home renovations demands dedication and smart financial planning. You must assess your renovation needs, set realistic budgets, and explore various saving strategies to transform your living space. Patience plays a vital role in this process, as it takes time to accumulate the necessary funds (but the wait is worthwhile).

Careful planning helps you reach your financial targets and make informed decisions about your renovation project. We at Cameron Construction specialize in turning renovation dreams into reality. Our team of experts can help you maximize your renovation budget and create the home you’ve always wanted.

You can start your journey to save for home renovations today. Set up a high-yield savings account, cut unnecessary expenses, or explore government rebates for energy-efficient upgrades. Your dream renovation is within reach, and with determination and smart financial strategies, you’ll enjoy your newly renovated space sooner than you think.