How to Refinance Your Home Loan for Renovations

At Cameron Construction, we understand the transformative power of home renovations.

Refinancing your home loan for renovations can be a smart way to fund your dream projects while potentially securing better loan terms.

This guide will walk you through the process of refinancing, helping you make informed decisions about your home improvement plans.

How Refinancing Works for Home Renovations

The Basics of Refinancing

Refinancing your home loan for renovations transforms your property’s potential. This financial strategy replaces your existing mortgage with a new one, often featuring better terms or additional funds for home improvements.

When you refinance, you take out a new loan to pay off your current mortgage. This new loan can exceed your existing one, providing extra funds for renovations. For instance, if your home’s value is $500,000 and you owe $300,000 on your mortgage, you might refinance for $400,000. This action would give you $100,000 for renovations while potentially securing a better interest rate on your entire loan.

Financial Advantages of Refinancing

Refinancing for renovations offers significant financial benefits. You may secure a lower interest rate than your current mortgage, potentially saving thousands over the loan’s life. Refinancing your home to fund renovations can provide a more competitive interest rate than you would get from a personal loan, for example.

Using your home equity to fund renovations likely results in a much lower interest rate than a personal loan or credit card. This approach can lead to considerable savings on interest payments over time.

Refinancing Options for Homeowners

Homeowners looking to fund renovations have several refinancing options:

- Cash-out refinance: This option allows you to borrow more than you owe on your current mortgage, giving you the difference in cash for renovations.

- Line of credit: This choice provides flexibility, allowing you to draw funds as needed up to a predetermined limit.

- Construction loan: Ideal for major renovations, this type of loan releases funds in stages as your project progresses.

Maximizing Your Refinance Value

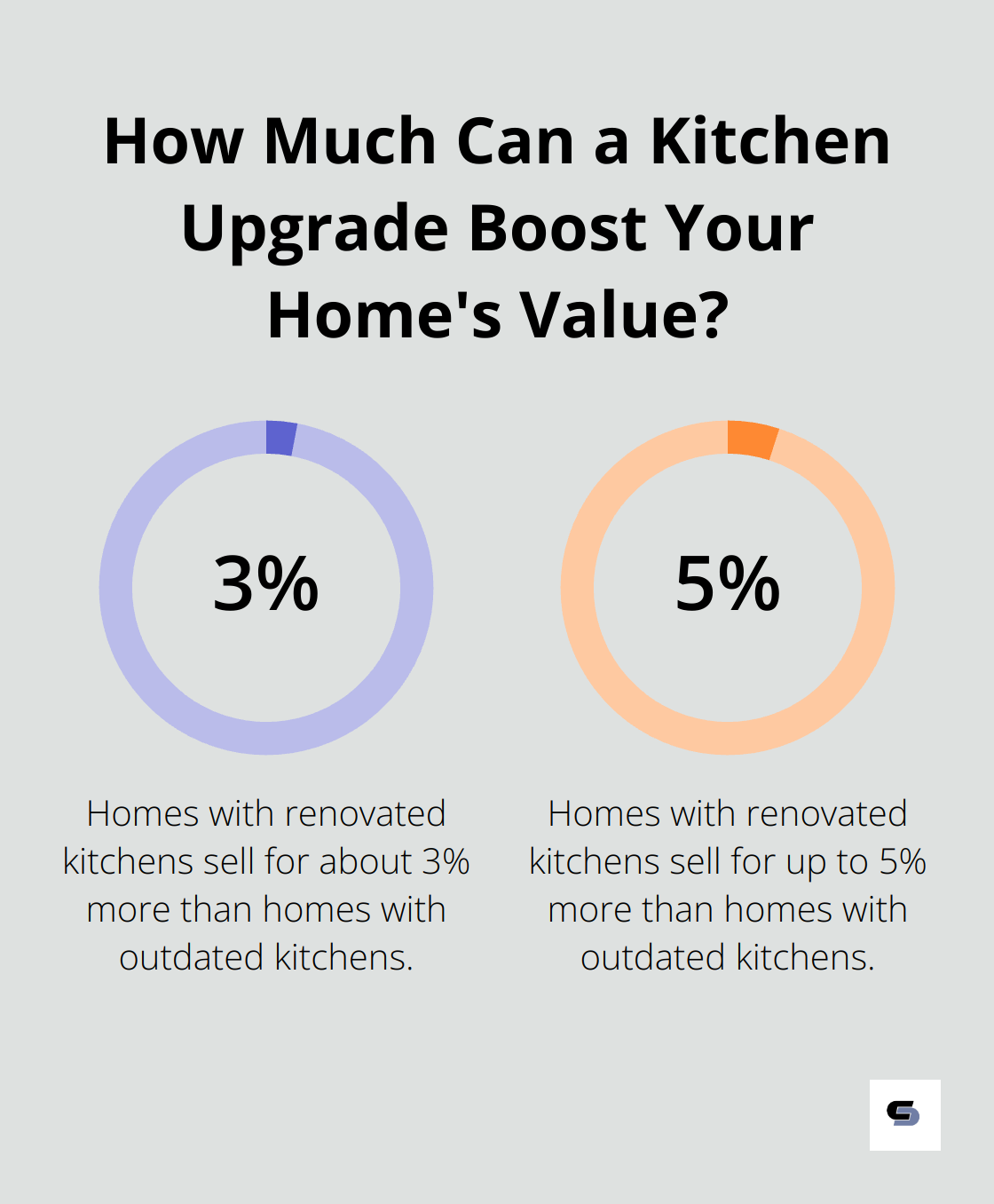

To optimize your refinance, create a clear renovation plan. Prioritize projects that will add the most value to your home. Homes with renovated kitchens sell for about 3%-5% more than homes with kitchens that are outdated or have a hint of despair.

Refinancing isn’t just about accessing funds; it’s about making strategic financial decisions that benefit you long-term. Always consider the total cost of the refinance (including fees and charges) against the potential benefits of your renovation project.

Planning Your Next Steps

As you explore refinancing options, consider consulting with financial professionals who can provide personalized advice based on your specific situation. They can help you navigate the complexities of refinancing and ensure you make the most informed decision for your home renovation goals.

How to Navigate the Refinancing Process

Evaluate Your Financial Health

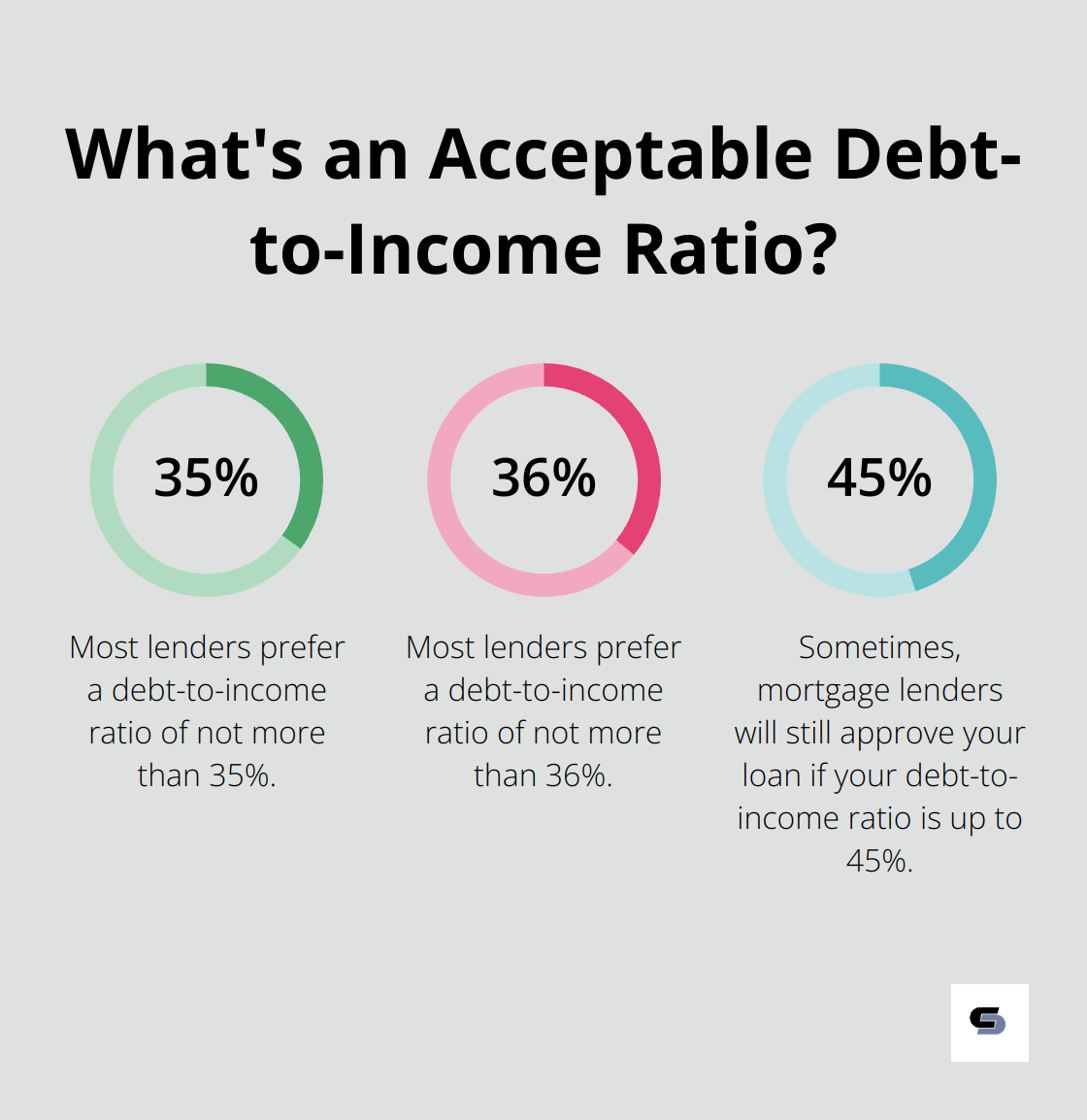

Before you start the refinancing process, take a close look at your current financial situation. Check your credit score, as it significantly impacts the interest rates lenders will offer you. Having a low credit score doesn’t necessarily disqualify you from refinancing your home loan, though it might make things trickier. Calculate your debt-to-income ratio as well. Most lenders like a DTI ratio of not more than 35% or 36%. Sometimes, mortgage lenders will still approve your loan if your DTI is up to 45%. If your ratio is higher, consider paying down some debts before you apply for refinancing.

Explore Lender Options

Don’t settle for the first offer you receive. Compare rates from at least three to five different lenders. Online comparison tools can help, but don’t rely solely on them. Speak directly with lenders to understand their specific terms and conditions. Ask about fees, closing costs, and whether they offer any special programs for renovation loans. Some lenders may offer better rates for energy-efficient upgrades (which could align well with your renovation plans).

Prepare Your Documentation

Lenders require extensive documentation to process your refinancing application. Typically, you’ll need to provide:

- Proof of income (pay stubs, tax returns for the past two years)

- Bank statements for the last few months

- Statements of assets and debts

- Property information (current mortgage statement, homeowners insurance)

- A detailed plan of your intended renovations

Have these documents ready in advance to speed up the application process. Many lenders now offer digital application options, making it easier to submit and track your application.

Submit Your Application

Once you’ve chosen a lender and gathered your documentation, submit your application. Be prepared for a thorough review process. Lenders will verify your information, assess your property’s value, and evaluate your renovation plans. This process can take several weeks, so patience is key.

During this time, avoid making any major financial changes, such as taking on new debt or changing jobs, as this could affect your application. If the lender requests additional information, respond promptly to keep the process moving.

Refinancing is a significant financial decision. While it can provide the funds needed for your dream renovation, it’s important to ensure the new loan terms align with your long-term financial goals. As you move forward with your refinancing plans, the next step is to consider how to maximize your refinancing for your specific renovation projects.

Maximizing Your Refinancing for Renovation Projects

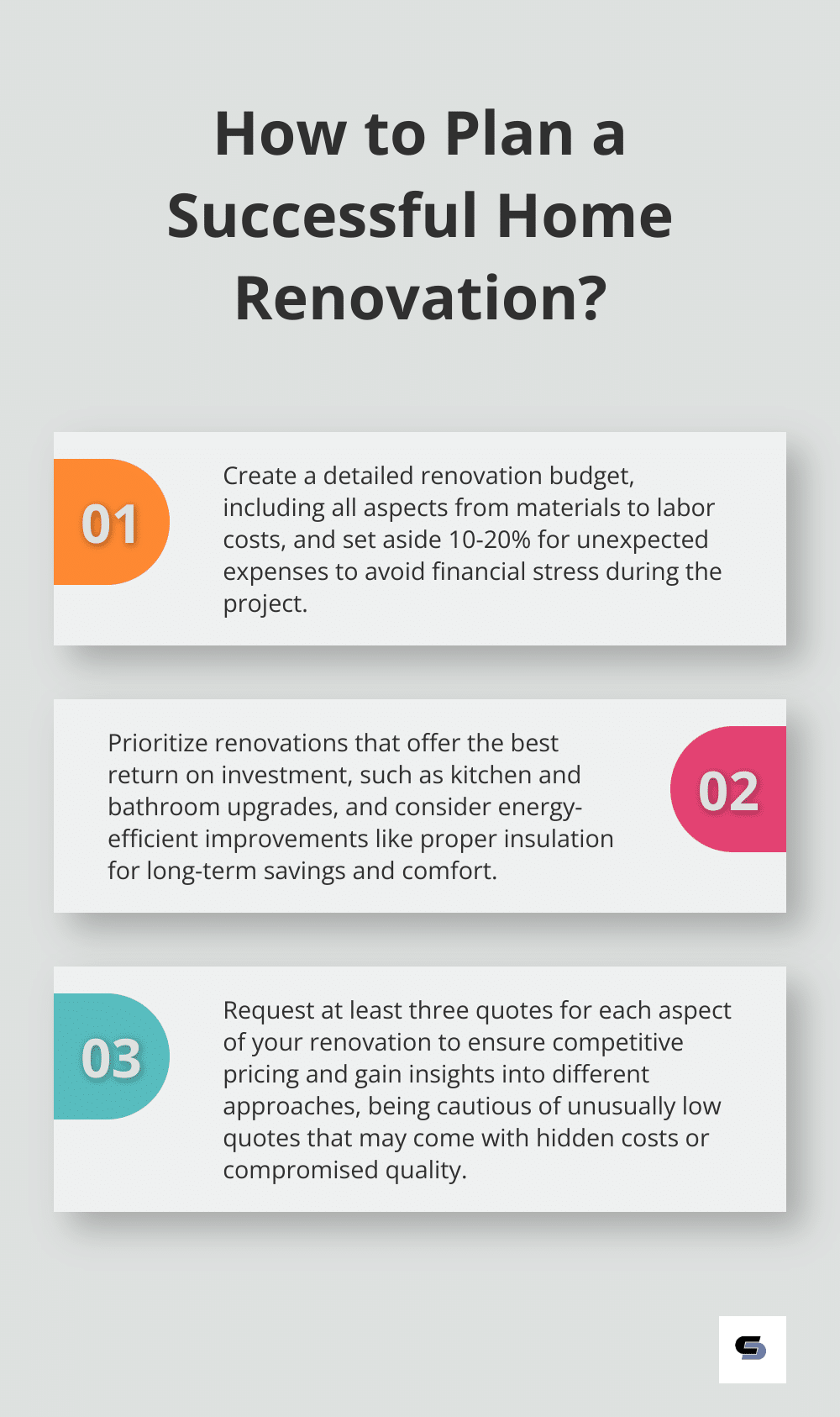

Create a Detailed Budget

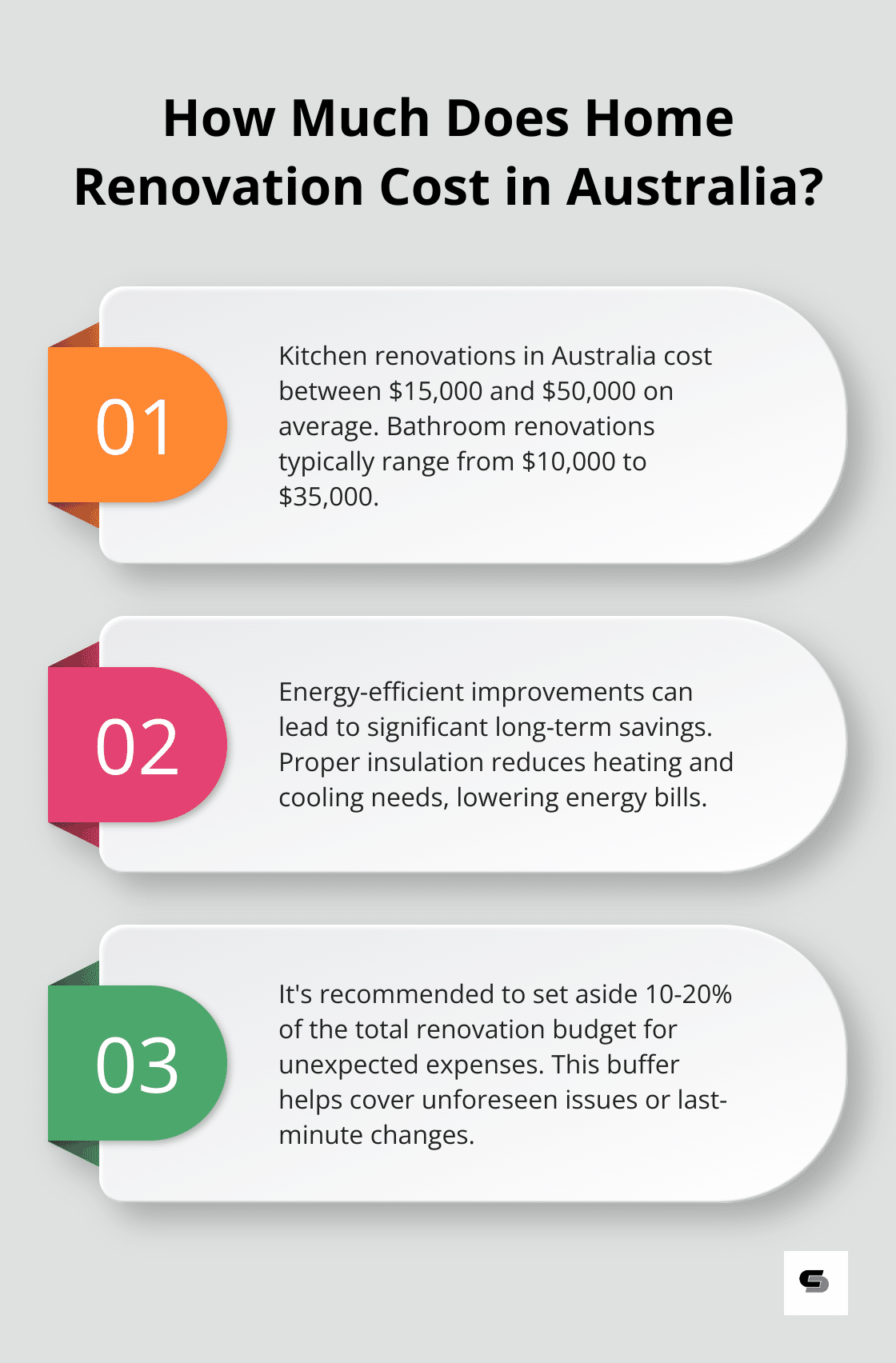

The first step to maximize your refinancing for renovations is to create a comprehensive budget. Include all aspects of your project, from materials to labor costs. The Housing Industry Association provides detailed reports on kitchen and bathroom costs in Australia. However, the exact figure can fluctuate based on factors such as size, materials, and complexity.

Focus on High-Return Investments

Prioritize renovations that offer the best return on investment. Kitchen and bathroom renovations typically yield high returns. Outdoor improvements like decks or landscaping can also significantly boost your home’s appeal and value.

Plan for Long-Term Value

When planning your renovations, consider upgrades that provide long-term benefits. Energy-efficient improvements, such as proper insulation, can lead to substantial savings over time. These improvements are crucial for maintaining a comfortable indoor temperature, reducing the need for heating in winter and cooling in summer.

Obtain Multiple Quotes

Always request at least three quotes for each aspect of your renovation. This practice ensures competitive pricing and provides insights into different approaches to your project. Exercise caution with quotes that seem unusually low – they often come with hidden costs or compromised quality.

Prepare for Unexpected Expenses

Set aside 10-20% of your total budget for unforeseen costs (this buffer can cover issues like structural problems discovered during the renovation or last-minute design changes). This preparation will help you avoid financial stress if unexpected issues arise.

Final Thoughts

Refinancing your home loan for renovations empowers homeowners to transform their living spaces while potentially improving their financial situation. This strategy allows access to funds at lower interest rates compared to personal loans or credit cards, making renovation dreams more attainable. Careful planning and thorough research ensure that the benefits outweigh the costs when you decide to refinance your home loan for renovations.

The complexities of refinancing and home renovations often benefit from professional guidance. We recommend you consult with financial advisors and experienced renovation experts to tailor your approach to your specific circumstances and goals. At Cameron Construction, we specialize in helping homeowners in Melbourne bring their renovation visions to life.

Our team of designers, engineers, and interior advisors can assist you in creating a renovation plan that aligns with your refinancing strategy (ensuring that your investment translates into tangible improvements in your home’s value and livability). Refinancing for renovations involves making strategic decisions that enhance your living space and financial future. You can embark on a renovation journey that transforms your house into the home of your dreams while making sound financial choices for your future.