How to Fund Your Home Renovation Project

At Cameron Construction, we understand that funding a home renovation project can be a daunting task. Many homeowners dream of transforming their living spaces but struggle with how to fund home renovations.

That’s why we’ve put together this comprehensive guide to explore various financing options available to you. From tapping into your home’s equity to leveraging government-backed loans, we’ll walk you through the most popular ways to finance your renovation dreams.

Unlocking Your Home’s Value for Renovations

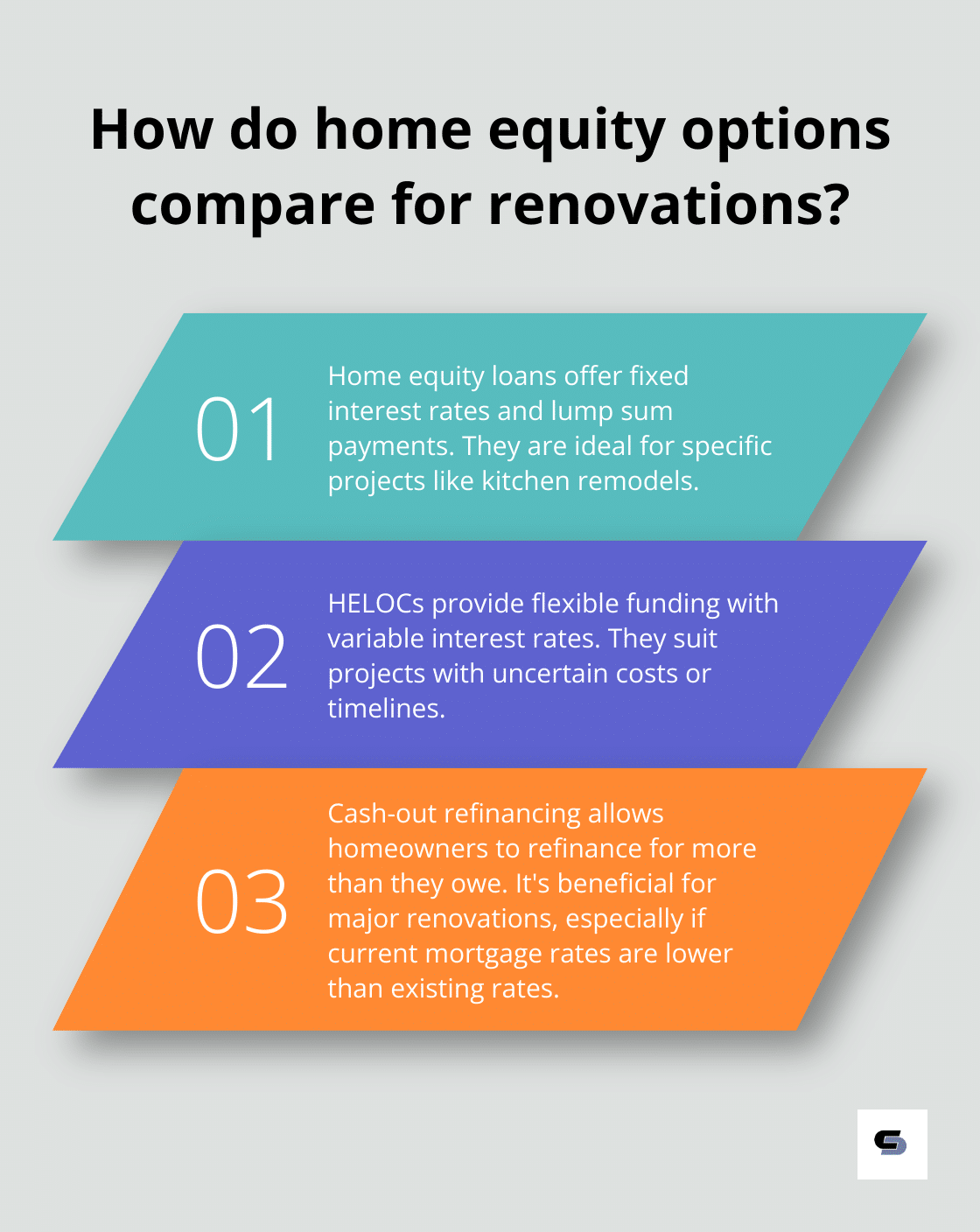

Home Equity Loans: A Fixed-Rate Solution

Home equity loans—commonly known in Australia as a home loan top-up or home equity release—allow you to borrow against the equity in your property. This typically means extending your existing mortgage or taking out a separate loan secured by your home.

These loans often come with fixed interest rates, making budgeting easier during your renovation. They’re ideal for major projects like kitchen overhauls or home extensions. While interest on these loans is generally not tax-deductible in Australia (unlike in the US), the predictability of repayments is a major advantage.

.

Line of Credit Loans: Flexible Funding for Ongoing Projects

A home equity line of credit (LOC) gives you access to funds up to a set limit, which you can draw down as needed. This suits renovations with fluctuating costs or evolving scopes.

While lines of credit offer flexibility, they usually come with variable interest rates, which can fluctuate with the RBA’s cash rate. It’s a solid choice if you value having funds on hand throughout your renovation process.

Refinancing with Cash-Out: Unlocking Equity at Lower Rates

Cash-out refinancing involves replacing your existing mortgage with a new one at a higher amount, allowing you to pocket the difference in cash for your renovation. This is most beneficial when interest rates are lower than your current mortgage rate.

Before making this move, speak with your lender or a mortgage broker to compare current rates and fees. Be mindful of refinancing costs such as break fees and loan establishment charges

Comparing Your Options

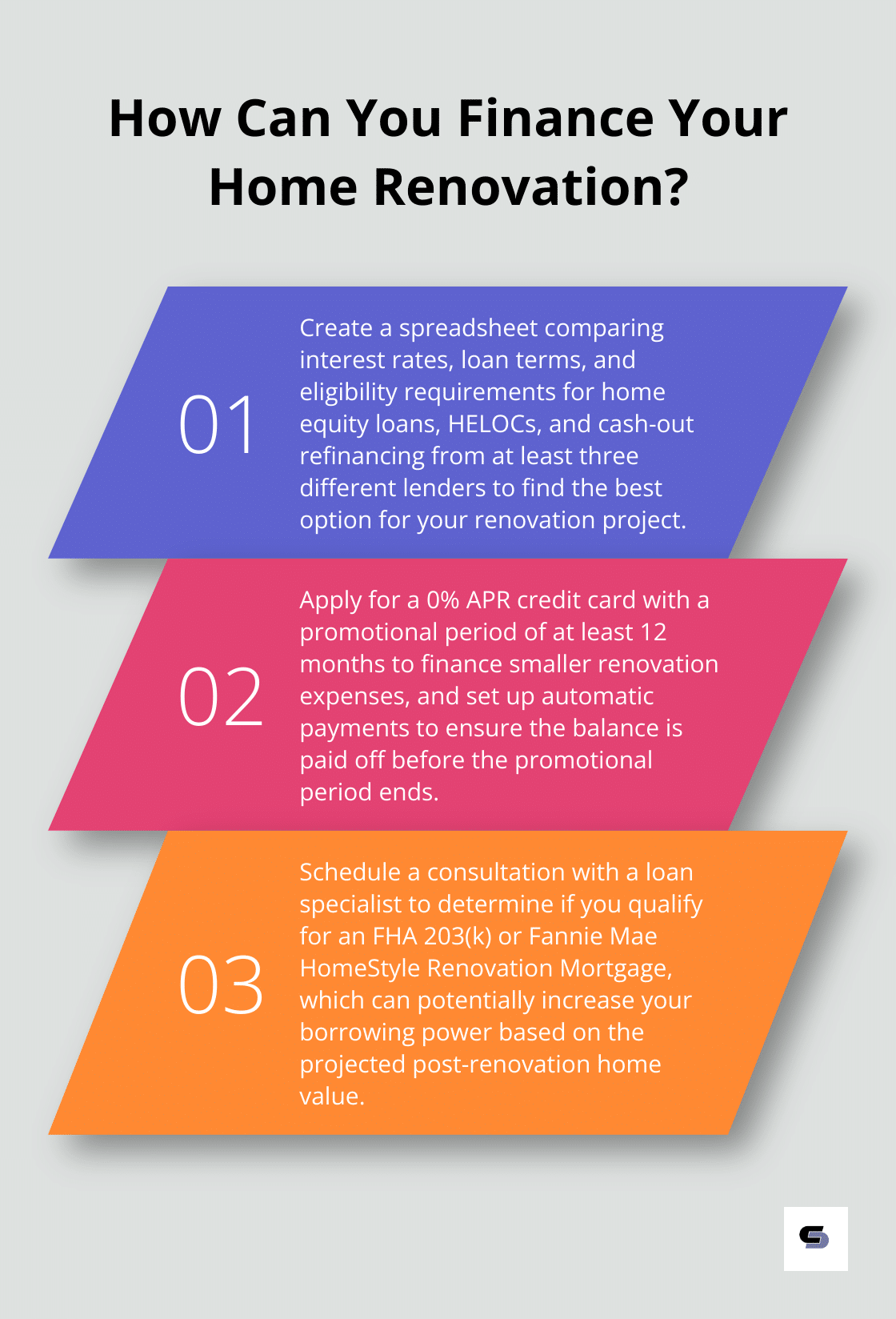

It’s crucial to compare loan options from several Australian lenders, including the big four banks, credit unions, and online lenders. Tools like Canstar, Finder, and Mozo can help you compare home loan products and interest rates side-by-side.

Remember: tapping into your home’s equity comes with the risk of losing your home if you can’t meet repayments. Be sure to calculate your borrowing capacity carefully and have a contingency plan.

Alternative Financing for Home Renovations

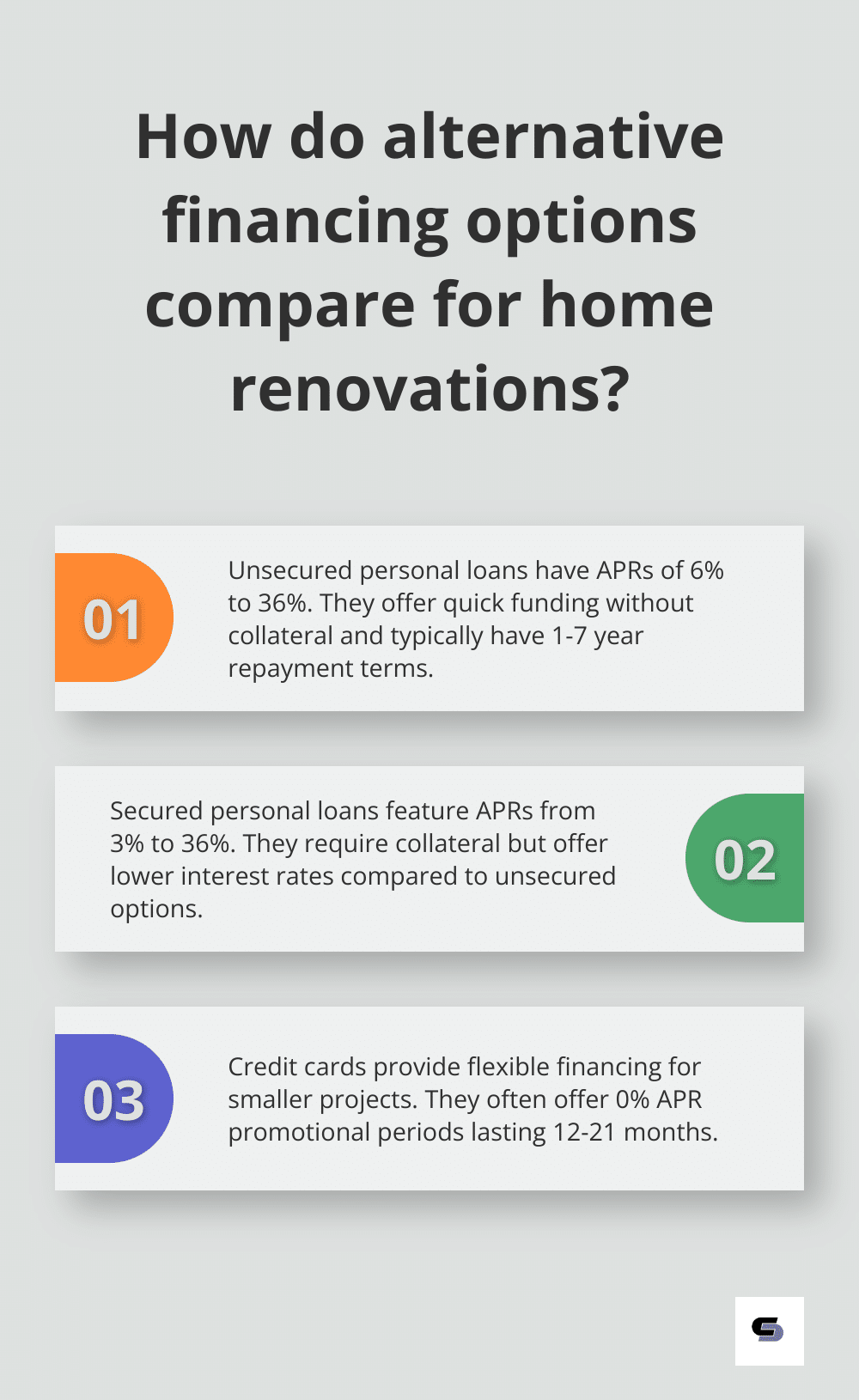

Unsecured Personal Loans: Quick Funding Without Collateral

Personal loans offer fast access to funds without using your home as security. In Australia, personal loan interest rates range from around 6% to 20%, depending on your credit score and the loan amount. Many Australians use personal loans for mid-sized renovations like bathroom upgrades.

These loans often have fixed terms of one to seven years, making it easier to budget for regular repayments.

Secured Personal Loans: Lower Rates with Added Security

If you’re open to offering security such as a car or savings account, a secured personal loan may offer a lower interest rate than unsecured loans. This option is ideal if you want to avoid refinancing your home loan but need access to a larger sum for renovations.

However, if you default on repayments, the lender has the right to claim the asset used as security.

Credit Cards: For Smaller or Short-Term Projects

Credit cards can be useful for covering small renovation costs or unexpected expenses. Many Australian banks offer 0% interest balance transfer or purchase deals for up to 24 months, allowing you to fund renovations interest-free if paid off on time.

Keep in mind the average credit card interest rate in Australia is around 18–21%, so a clear repayment strategy is essential to avoid high costs.

Government Loans for Home Renovations

FHA 203(k) Rehabilitation Loan

While Australia doesn’t have programs like the US FHA 203(k), there are government schemes that may assist eligible homeowners with renovation funding:

First Home Owner Grant (FHOG) – With Renovation Potential

While the FHOG is mainly for new builds, some states and territories allow it to be used toward substantial renovations in specific circumstances. Check your state’s rules for eligibility.

State-Based Energy Rebates and Sustainability Grants

Many states and local councils offer grants or rebates for energy-efficient home improvements, such as installing solar panels, insulation, or water-saving devices.

- Victorian Energy Upgrades (VEU)

- NSW Energy Savings Scheme

- ACT Sustainable Household Scheme

These programs can significantly reduce out-of-pocket expenses on eco-friendly renovations.

NDIS and Aged Care Home Modifications

If you’re renovating for accessibility or medical reasons, funding may be available through the National Disability Insurance Scheme (NDIS) or My Aged Care. These programs support eligible Australians in making homes safer and more accessible.

Navigating Your Renovation Financing

Every renovation is unique, and so is every homeowner’s financial situation. Whether you’re extending your home, modernising a kitchen, or increasing energy efficiency, it’s essential to:

- Get pre-approval if borrowing funds.

- Compare interest rates and loan features.

- Set a realistic renovation budget.

- Work with experienced builders and advisors to avoid unexpected costs.

Speaking to a mortgage broker, financial advisor, or renovation finance specialist can help you choose the right strategy and avoid financial pitfalls.

Final Thoughts

At Cameron Construction, we know that a well-executed renovation not only improves your quality of life but also boosts your home’s value. Whether you’re financing through your mortgage, a personal loan, or state-based support, having the right funding in place is the key to a smooth renovation journey.

Our team of experienced designers, engineers, and project managers will work with you to ensure your budget aligns with your goals—helping you make informed choices at every step.

Ready to explore your home renovation?

Visit Cameron Construction and discover how we can help turn your dream space into reality—on time, on budget, and tailored to your lifestyle.

Financial advisors can provide valuable insights into the tax implications and long-term effects of different funding options. Renovation experts can help you plan your project effectively, ensuring you borrow the right amount and allocate funds wisely. At Cameron Construction, we understand that a well-executed renovation can significantly enhance your home’s value and your quality of life.

Our team of experienced designers, engineers, and interior advisors can guide you through the renovation process, helping you make informed decisions about your project scope and budget. For expert guidance on your home renovation project and to learn more about how we can help bring your vision to life, visit Cameron Construction. We will ensure your renovation journey adds lasting value to your home.

Disclaimer: The information provided in this article is for general informational purposes only and does not constitute financial advice. Cameron Construction is not a licensed financial advisor or mortgage broker. We recommend consulting with a qualified financial professional before making any decisions related to financing your home renovation.