How to Finance Your Home Renovation Project

At Cameron Construction, we understand that financing a home renovation project can be daunting.

Many homeowners are eager to upgrade their living spaces but aren’t sure about the best ways to pay for home renovations.

This guide will explore various financing options, help you determine your budget, and show you how to maximize your renovation’s return on investment.

How Can You Fund Your Home Renovation?

Tap into Your Home’s Equity

Home equity loans and lines of credit (HELOCs) offer popular choices for funding renovations. These options allow you to borrow against the equity you’ve built in your home. The Australian Bureau of Statistics reported that the average loan size for owner-occupier dwellings reached $666,000 in December 2024, which indicates a trend towards leveraging home equity for improvements.

HELOCs provide flexibility, as you can draw funds as needed during your renovation. You’ll only pay interest on the amount you use (which can benefit projects with uncertain costs).

Refinance for Renovation Funds

Cash-out refinancing presents another option to consider. This method involves replacing your existing mortgage with a larger loan and using the difference for renovations. It’s particularly advantageous when current interest rates fall below your original mortgage rate.

Use Personal Loans for Smaller Projects

For less extensive renovations, personal loans can provide a viable option. While they typically have higher interest rates than home equity loans, they don’t require using your home as collateral.

Explore Government Support for Renovations

Government-backed programs can offer additional support when planning your renovation. While the HomeBuilder grant introduced in 2020 has ended, other state-specific programs may exist. These programs often have strict eligibility criteria, so research what’s currently offered in your area.

When you evaluate your financing options, compare interest rates, terms, and overall costs. Consult with a financial advisor to determine the best strategy for your specific situation. The right financing choice can turn your renovation dreams into reality while safeguarding your financial future.

Now that you understand various financing options, let’s move on to determining your budget and project scope. This step will help you choose the most appropriate funding method and ensure your renovation stays on track.

How Much Will Your Renovation Cost?

Evaluate Your Financial Health

Take a hard look at your current financial situation. Review your income, expenses, and savings. Calculate how much you can comfortably allocate to your renovation without straining your finances. Consider not just the immediate costs, but also how the renovation might impact your long-term financial goals.

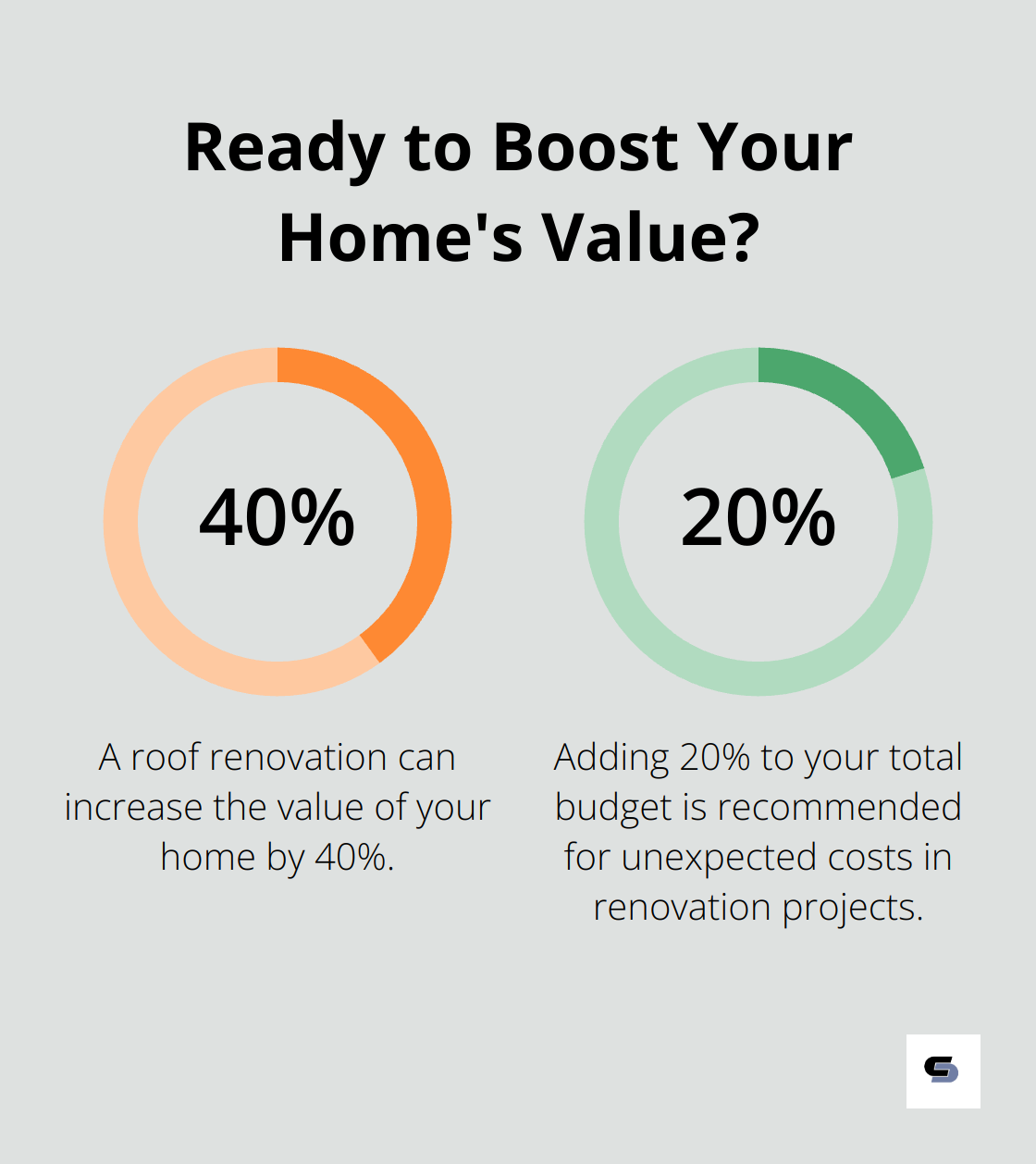

A roof renovation can increase the value of your home between 15% and 40%. However, the amount that a roof renovation adds to the value of a home depends on various factors.

Get Multiple Detailed Quotes

Once you have a ballpark figure in mind, it’s time to get specific. Contact at least three reputable contractors for detailed quotes. Provide them with as much information as possible about your project scope and expectations.

When you receive the quotes, don’t just look at the bottom line. Break down the costs for materials, labor, and any subcontractor work. This detailed approach will help you identify areas where you might save or where you might need to allocate more funds.

Plan for the Unexpected

Surprises are almost inevitable in renovation projects. Set aside a contingency fund to cover unforeseen expenses.

Add 15-20% to your total budget for unexpected costs. This could cover anything from discovering structural issues (once walls are opened up) to last-minute design changes.

Consider Long-Term Value

When budgeting for your renovation, think beyond the immediate costs. Consider how the improvements will add value to your home in the long run. Some renovations (like kitchen upgrades or energy-efficient improvements) can offer a higher return on investment than others.

Factor in Financing Costs

If you’re using a loan to finance your renovation, don’t forget to include the cost of borrowing in your budget. Calculate the total interest you’ll pay over the life of the loan and factor this into your overall renovation cost.

A well-planned budget forms the foundation of a successful home improvement project. With a clear understanding of the costs involved, you’ll be better equipped to choose the right financing option and move forward with confidence. Next, let’s explore how to maximize your renovation’s return on investment.

How to Boost Your Home’s Value Through Smart Renovations

Prioritize Kitchen and Bathroom Upgrades

Kitchens and bathrooms offer the highest return on investment for home renovations. A well-planned kitchen renovation typically yields substantial returns, with kitchens claiming an estimated ROI between 75% and 100%. Focus on modern, energy-efficient appliances, durable countertops, and ample storage space. For bathrooms, update fixtures, improve lighting, and add luxury touches like heated floors or a double vanity.

Enhance Energy Efficiency

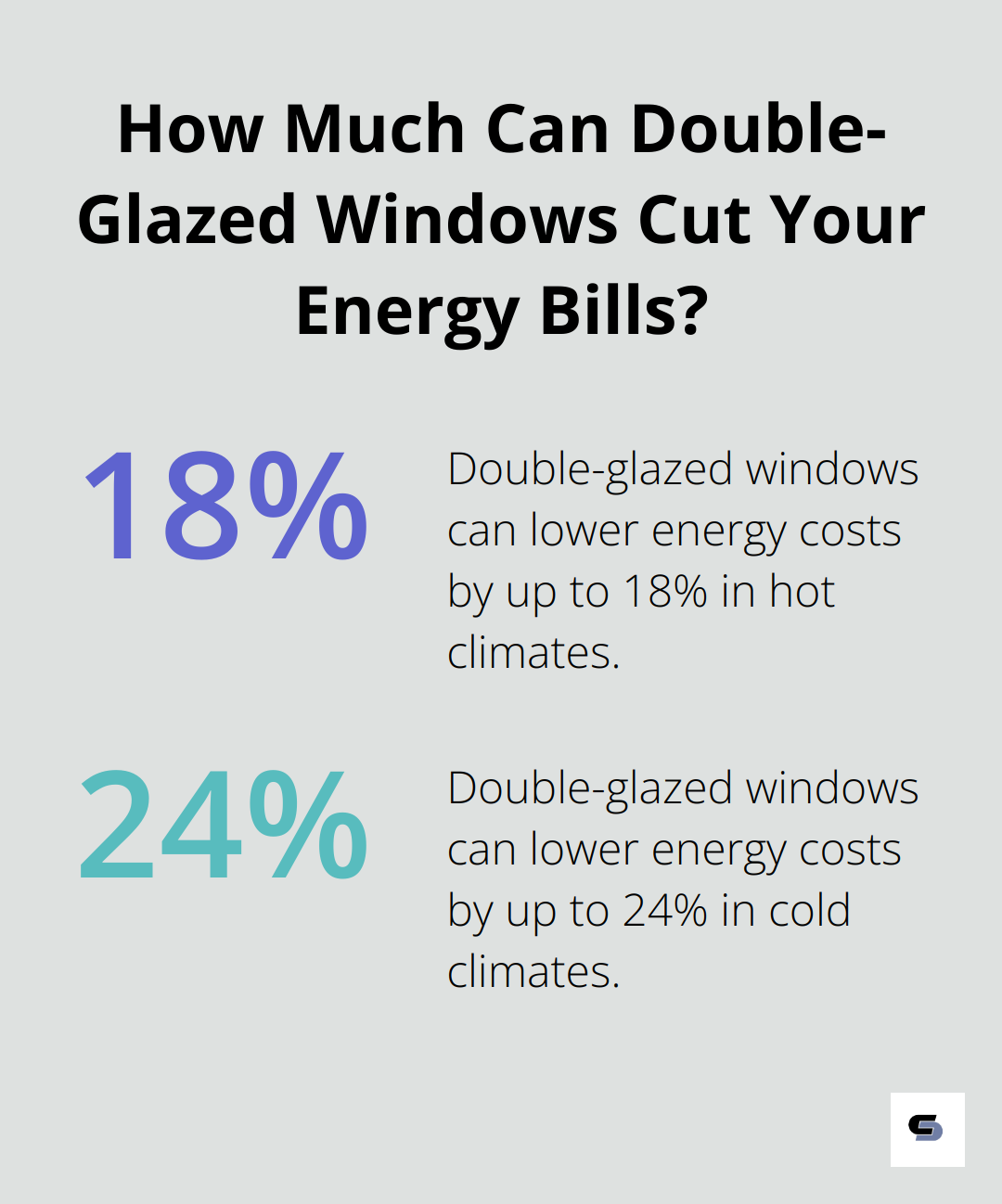

Energy-efficient upgrades reduce your utility bills and appeal to environmentally conscious buyers. Install double-glazed windows to lower energy costs by up to 18% in hot climates and 24% in cold climates (as per the Australian Government’s Your Home guide). Other high-value improvements include adding insulation, upgrading to LED lighting, and installing solar panels. These changes significantly reduce energy consumption and increase your home’s appeal to potential buyers.

Create Functional Outdoor Spaces

In Australia’s climate, outdoor living spaces hold high value. Add a deck or patio to recoup up to 75% of its cost at resale. Create an outdoor kitchen or entertainment area to effectively extend your living space and appeal to a wide range of buyers. Improve landscaping by adding native plants or installing a water-efficient irrigation system to boost curb appeal and property value.

Increase Living Space

Add usable square footage to your home to increase its value. Finish a basement, convert an attic into a bedroom, or build an extension. While these projects require significant investment, they offer substantial returns. Converting your loft into an additional living space can increase your home value by 20 to 25% and add valuable living space without altering your home’s footprint.

Modernize with Smart Home Technology

Incorporate smart home features to set your property apart in a competitive market. Install smart thermostats, security systems, and lighting controls to offer convenience and lead to energy savings. While the return on investment for these upgrades can vary, tech-savvy buyers increasingly expect them, making your home stand out.

Final Thoughts

Home renovations can transform your living space and increase property value. We explored various ways to pay for home renovations, including equity loans, refinancing, and personal loans. The right financing option depends on your specific circumstances and project scope.

Careful planning and budgeting are essential for a successful renovation project. Assess your financial situation, obtain detailed quotes, and set aside a contingency fund to prepare for potential challenges. Smart renovation choices can yield substantial benefits in the long run.

Cameron Construction understands the intricacies of home renovations and extensions. Our team of experts can guide you through every step of your renovation journey, from initial design to final execution. We strive to deliver quality craftsmanship and ensure your renovation aligns with your vision and lifestyle needs (while staying on time and within budget).