Can You Write Off Home Renovations on Your Taxes?

At Cameron Construction, we often get asked about the tax implications of home renovations. Many homeowners wonder if they can write off their renovation expenses on their taxes.

The answer isn’t always straightforward, but understanding the rules can lead to significant savings. In this post, we’ll explore which home renovations qualify for tax write-offs and how to properly document your expenses.

Tax Deductions for Home Renovations Explained

Repairs vs. Improvements: A Critical Distinction

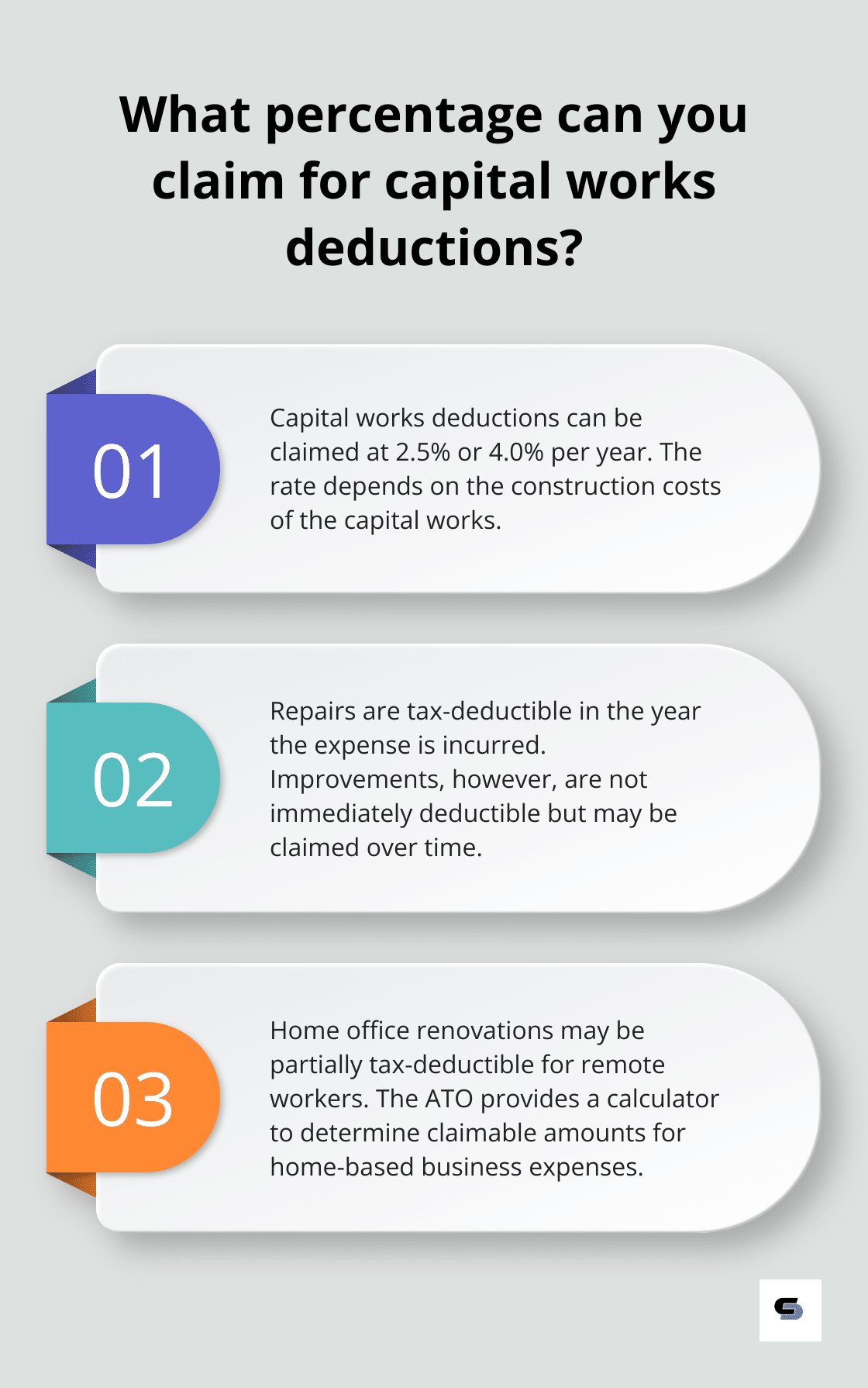

The Australian Taxation Office (ATO) draws a clear line between repairs and improvements. Repairs restore something to its original condition (e.g., fixing a leaky roof) and are typically tax-deductible in the year you incur the expense. Improvements enhance or add value to your property and aren’t immediately deductible but may be claimed over time.

Capital Works and Depreciation: Long-Term Benefits

Significant renovations fall under capital works. The ATO allows you to claim these expenses at a rate of 2.5% or 4.0% per year, depending on the construction costs of the capital works. Some items (like appliances or carpets) can be claimed as depreciating assets. The ATO provides guidelines on the lifespan of these items and the claimable amount each year.

Home Office Renovations: Work-From-Home Considerations

The rise of remote work has increased the popularity of home office renovations. If you use part of your home exclusively for work, you might claim a portion of your renovation costs. The ATO’s home office expenses calculator helps determine claimable amounts for home-based business expenses.

Energy-Efficient Upgrades: Green Renovations

Installing solar panels or improving insulation? These energy-efficient upgrades might qualify for additional tax incentives. The government’s energy.gov.au website offers information on available rebates and incentives for eco-friendly home improvements.

Rental Property Renovations: Different Rules Apply

Renovating a rental property involves different rules. Most expenses can be claimed either immediately or over several years. It’s crucial to keep detailed records of all expenses, as the ATO closely scrutinizes rental property claims.

Tax implications of home renovations can be complex. We at Cameron Construction always recommend consulting with a tax professional before undertaking major renovations. They provide tailored advice based on your specific situation and ensure you maximize your tax benefits while complying with ATO regulations. In the next section, we’ll explore specific types of renovations that are tax-deductible and how to make the most of these opportunities.

Tax-Deductible Home Renovations: Maximizing Your Benefits

Energy-Efficient Upgrades

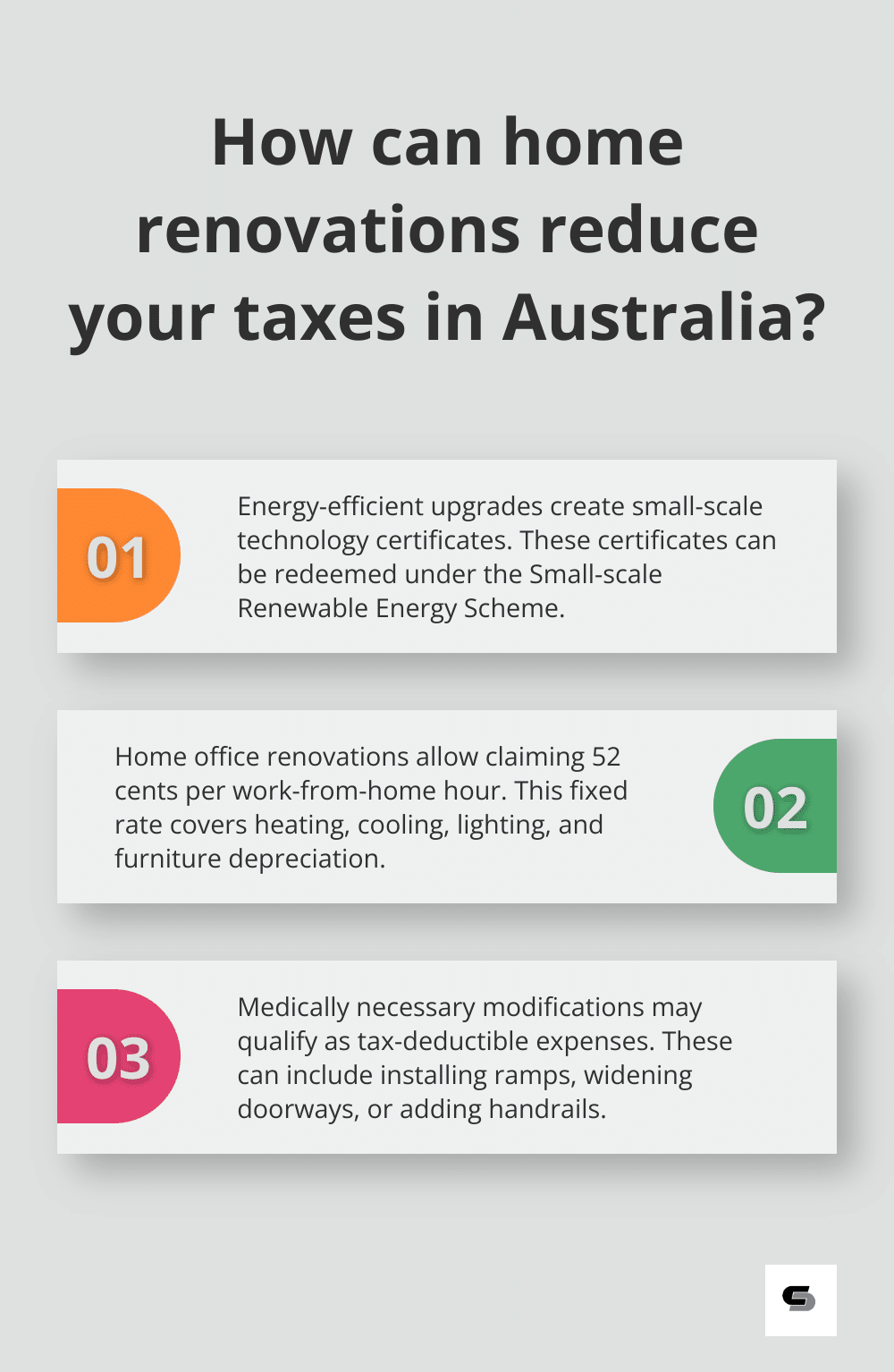

The Australian government offers incentives for eco-friendly renovations. Installing an eligible system allows the creation of small-scale technology certificates (STCs) with a value that can be redeemed by selling or assigning them under the Small-scale Renewable Energy Scheme (SRES). Other energy-efficient improvements (insulation, energy-efficient windows, solar hot water systems) may qualify for state-specific rebates. The Victorian Energy Upgrades program, for example, offers discounts on energy-efficient products and installations.

Home Office Renovations

Remote work has increased the popularity of home office renovations. If you use a part of your home exclusively for work, you can claim a percentage of your renovation costs. This includes expenses for painting, flooring, lighting, and built-in storage for your home office area.

The Australian Taxation Office (ATO) allows claims using two methods:

- Fixed rate method: Claim 52 cents per work-from-home hour (covers heating, cooling, lighting, and furniture depreciation).

- Actual cost method: Requires detailed record-keeping but may result in higher deductions.

Medically Necessary Modifications

Renovations to accommodate a disability or medical condition often qualify as tax-deductible. These include installing ramps, widening doorways, modifying bathrooms, or adding handrails. The ATO considers these as medical expenses, which you may claim if they exceed the relevant threshold.

Keep detailed records and obtain a doctor’s recommendation for these modifications. While the full cost may not always be deductible, a significant portion often is, providing both improved quality of life and potential tax benefits.

Rental Property Improvements

Investment properties have more generous rules for tax deductions on renovations. Most expenses related to maintaining or improving a rental property can be claimed either immediately or over several years through depreciation.

Immediate deductions often apply to repairs and maintenance (fixing leaky taps, repainting). Capital improvements to your property are subject to CGT and should be checked against cost thresholds.

Navigating Tax Deductions

Understanding which renovations qualify for tax deductions can save you money and enhance your property’s value. However, tax laws can be complex and change frequently. To ensure you maximize your benefits while complying with ATO regulations, consult a tax professional before undertaking major renovations. They can provide tailored advice based on your specific situation and help you navigate the intricacies of claiming renovation expenses on your taxes.

As we move forward, we’ll explore the critical aspect of record-keeping and documentation for your home renovation tax deductions. Proper documentation is the key to successfully claiming these benefits and avoiding potential issues with the ATO.

How to Document Home Renovations for Tax Purposes

Create a Dedicated Renovation File

Set up a physical or digital folder specifically for your renovation project. This folder should contain all relevant documents, including:

- Receipts for materials and labor

- Contracts with contractors and subcontractors

- Before and after photos of the renovated areas

- Building permits and inspection reports

- Architectural plans or sketches

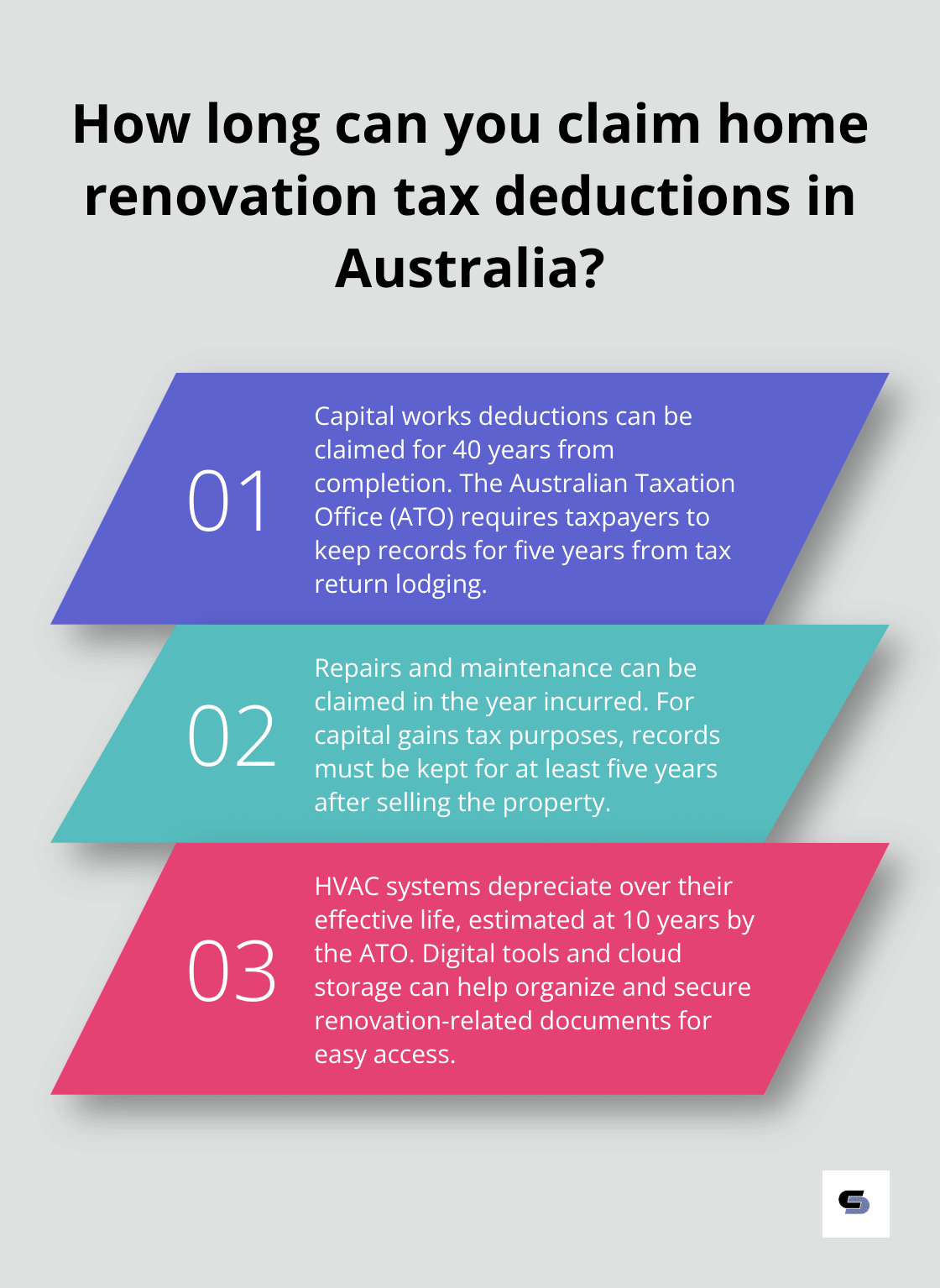

The Australian Taxation Office (ATO) requires taxpayers to keep records for five years from the date of lodging the relevant tax return. For capital gains tax purposes, you’ll need to keep records for at least five years after you sell the property.

Track Improvement Costs Over Time

Some renovation expenses, particularly those classified as capital improvements, depreciate over several years. Keep a spreadsheet or use accounting software to track these costs annually. This practice not only helps with tax claims but also provides a clear picture of your property’s increasing value over time.

For example, if you install a new HVAC system, you’ll need to track its depreciation over its effective life (the ATO estimates 10 years for most air conditioning units).

Understand What Qualifies as a Deduction

Not all renovation expenses are tax-deductible. Generally, you can claim repairs and maintenance in the year you incur them, while capital works deductions can be claimed for 40 years from the date the construction was completed. The ATO provides guidelines on what qualifies as a capital works deduction, which includes most structural improvements to your property.

Adding a room or renovating a kitchen typically counts as a capital improvement, while fixing a leaky roof classifies as a repair.

Consult with a Tax Professional

Tax laws can be complex and change frequently. We recommend you consult with a qualified tax professional before you undertake major renovations. They can provide tailored advice based on your specific situation and ensure you maximize your tax benefits while staying compliant with ATO regulations.

A tax professional can also help you navigate more complex scenarios, such as renovations on investment properties or home offices (which have different rules and potential deductions).

Use Technology to Your Advantage

Consider using digital tools to streamline your documentation process. Many smartphone apps allow you to scan receipts and organize them digitally. Cloud storage solutions (like Google Drive or Dropbox) can help you keep all your renovation-related documents in one secure, accessible location.

These digital tools not only make record-keeping easier but also ensure you have backups of all important documents related to your renovation project.

Final Thoughts

Home renovations can offer aesthetic improvements and potential tax write-offs when approached strategically. Certain types of renovations, such as energy-efficient upgrades and home office improvements, may qualify for tax benefits. Understanding the distinction between repairs and capital improvements affects how and when you can claim these expenses on your taxes.

Proper documentation forms the foundation of successful home renovation tax write-offs. Detailed records, including receipts, contracts, and photos, substantiate claims to the Australian Taxation Office. Strategic home improvements enhance living spaces and provide long-term financial benefits through tax savings and increased property value.

Cameron Construction offers expert guidance and quality craftsmanship for home renovations and extensions. Our team of designers, engineers, and interior advisors can help you navigate the complexities of home improvement projects (while potentially maximizing tax benefits). Always consult with a qualified tax professional before undertaking major renovations to ensure compliance with current regulations.