Borrowing Money for Home Renovations: Options Explained

At Cameron Construction, we understand that borrowing money for home renovations can be a complex decision.

Homeowners often face a variety of options when it comes to financing their remodeling projects.

In this post, we’ll explore different borrowing methods, from home equity loans to government-backed programs, to help you make an informed choice.

Tapping into Home Equity for Renovations

Home Equity Loans Explained

Home equity loans allow homeowners to borrow a lump sum against their home’s equity. Home equity is the difference between your property’s market value and the balance of your mortgage. The loan amount depends on this difference. For instance, if your home is worth $500,000 and you owe $300,000 on your mortgage, you have $200,000 in equity. Lenders typically permit borrowing up to 80% of your home’s value minus your mortgage balance.

These loans usually come with fixed interest rates and terms ranging from 5 to 30 years. This structure makes them suitable for large, one-time renovation projects with predictable costs.

How HELOCs Work

A Home Equity Line of Credit (HELOC) offers more flexibility than a traditional home equity loan. Instead of receiving a lump sum, you get access to a revolving credit line. You can withdraw funds as needed during the draw period (which typically lasts 5 to 10 years). After that, you enter the repayment period.

HELOCs usually have variable interest rates, which means your payments can change over time. During the draw period, typically spanning 5-10 years, homeowners can access funds. This option works well for ongoing or phased renovation projects where costs may spread out over time.

Advantages of Using Home Equity

Using home equity for renovations offers several benefits:

- Lower interest rates: Rates are generally lower than personal loans or credit cards because your home serves as collateral.

- Potential tax benefits: The interest may be tax-deductible (always consult a tax professional for advice).

- Large loan amounts: You can often borrow more with a home equity loan than with other types of loans.

Risks to Consider

While home equity loans can be attractive, they come with risks:

- Your home is collateral: If you can’t make payments, you could face foreclosure.

- Market fluctuations: If your home’s value decreases, you could end up owing more than it’s worth.

- Long-term debt: These loans can extend your debt obligations for decades.

Financial Planning is Key

Before applying for any loan, get a detailed quote for your renovation project. This step helps ensure you borrow the right amount and can manage repayments comfortably. A well-planned renovation not only enhances your living space but can also be a sound financial investment when done responsibly.

As we move on to discuss personal loans for home improvements, it’s important to consider how these options compare to home equity loans in terms of interest rates, loan terms, and overall costs.

Personal Loans for Renovations

Types of Personal Loans

Personal loans offer a different approach to financing home improvements. Unlike home equity loans, these don’t use your property as collateral. This makes them an attractive option for homeowners who either lack sufficient equity or prefer not to risk their homes.

When considering personal loans for renovations, you’ll encounter two main types: secured and unsecured. Secured loans require collateral (such as a car or savings account), which can lead to lower interest rates. Unsecured loans don’t require collateral but typically come with higher interest rates due to the increased risk for lenders.

Personal loans for renovations allow you to borrow from $5,000 with loan terms ranging from one to seven years, offering weekly, fortnightly or monthly repayment options.

Interest Rates and Loan Terms

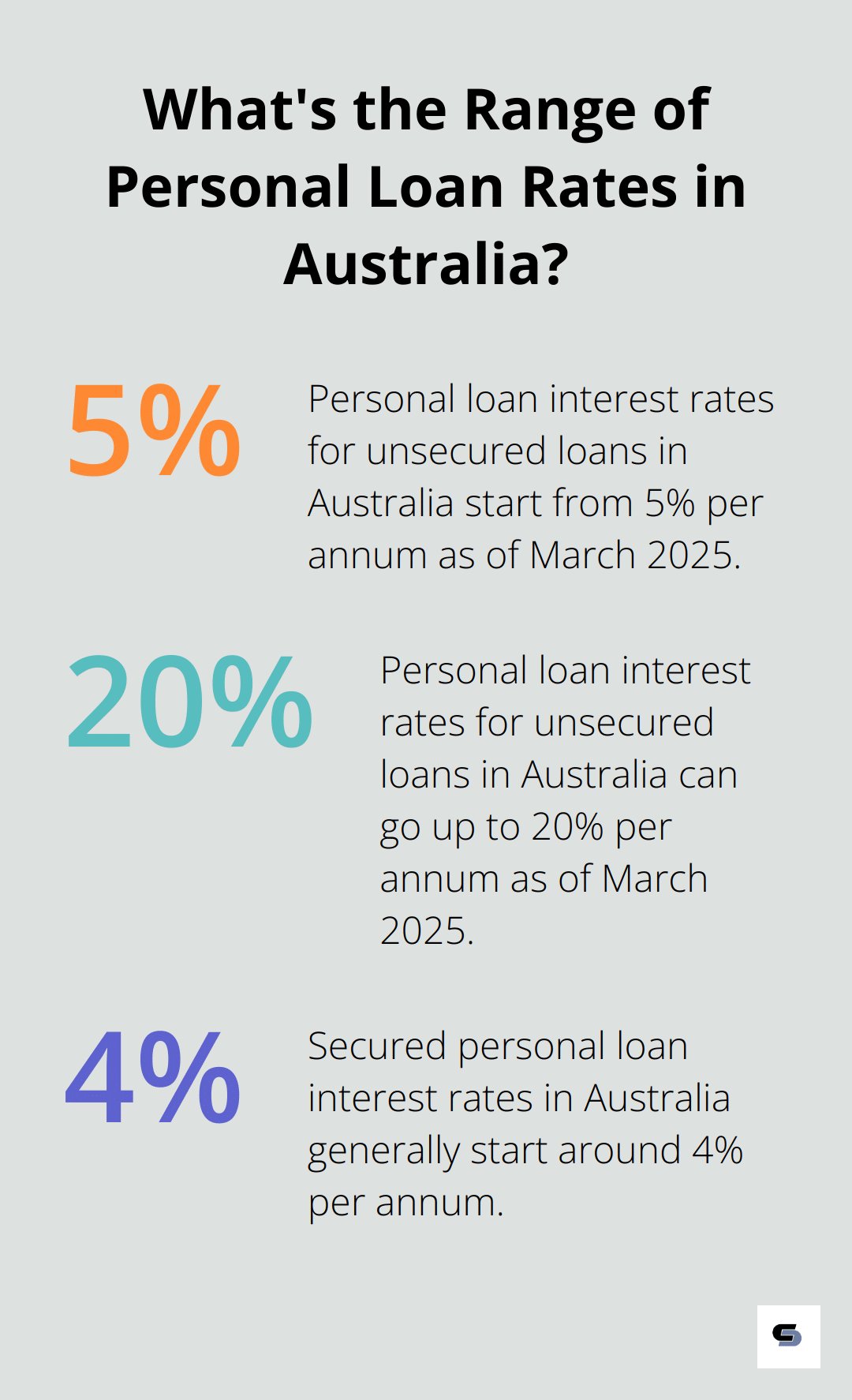

Personal loan interest rates vary widely based on factors like credit score, income, and loan amount. As of March 2025, rates for unsecured personal loans in Australia range from 5% to 20% per annum. Secured personal loans generally offer lower rates, often starting around 4%.

Loan terms for personal loans are typically shorter than those for home equity products, usually ranging from 1 to 7 years. This shorter term means higher monthly payments but less interest paid over the life of the loan.

Advantages of Personal Loans

Personal loans come with several advantages for home renovations. They often receive faster approval than home equity loans, with some lenders offering same-day approval and funding. They also don’t require a home appraisal, which can save time and money.

Considerations for Larger Projects

Recent statistics show that the value of personal loans reached a new high in the December quarter of 2024, indicating new trends in borrower demand.

Personal loans can work well for minor updates to more substantial renovations. The key is to match the loan amount and terms with your specific renovation needs and financial situation.

For major projects, exploring home equity options or speaking with a financial advisor might prove beneficial. Personal loans can provide a quick solution, but they’re not always the most cost-effective for large-scale renovations.

As we move on to discuss government-backed renovation loans, it’s important to consider how these options compare to personal loans in terms of eligibility, interest rates, and overall benefits for homeowners.

Government Loans for Home Renovations

FHA 203(k) Rehabilitation Loan Program

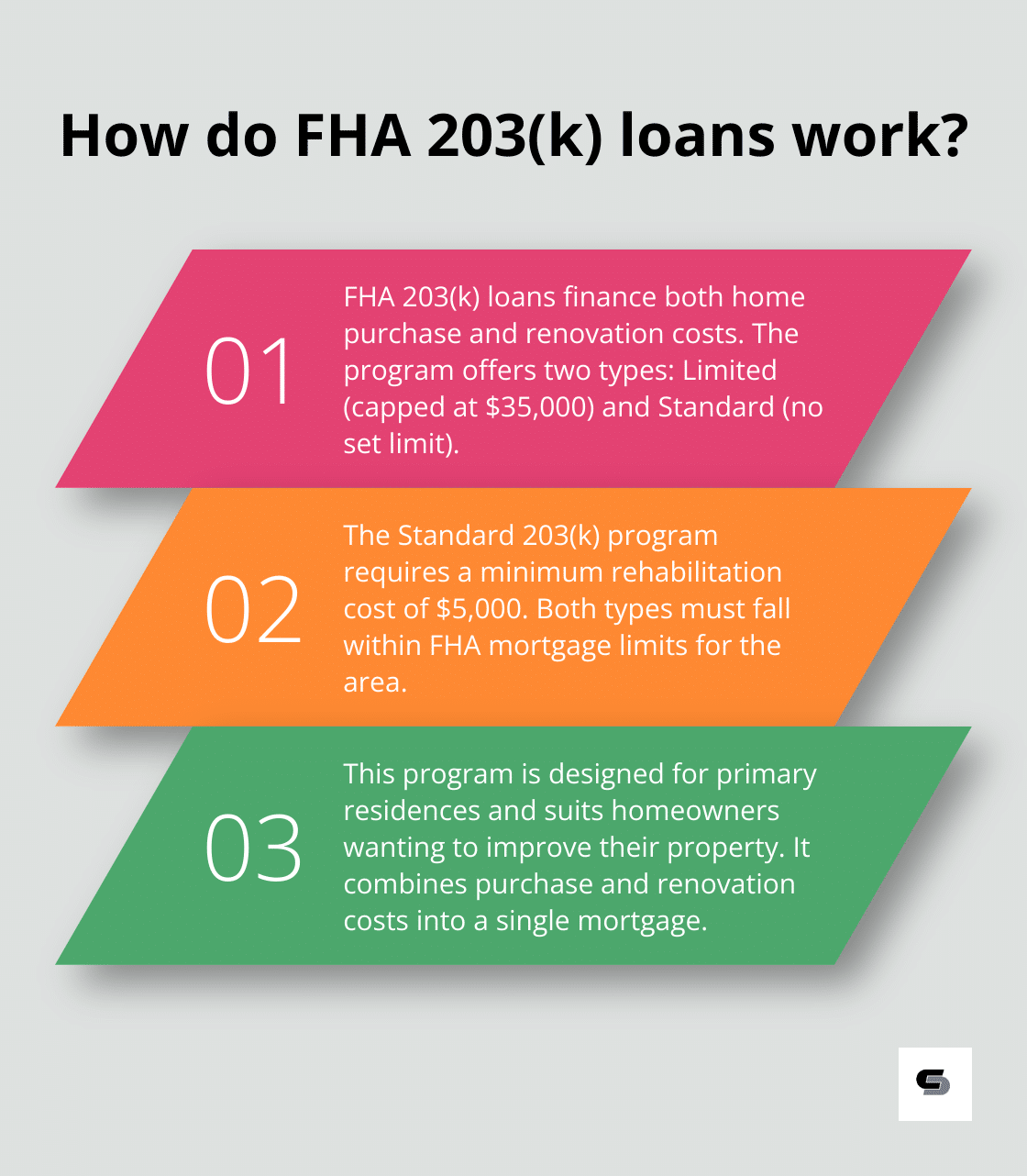

The FHA 203(k) program enables homeowners to finance both home purchase and renovation costs in a single mortgage. This program suits those who want to improve their primary residence. The Standard 203(k) program is for major rehabilitation and repair of single-family properties, with the cost of rehabilitation required to be at least $5,000.

The program offers two types of 203(k) loans:

- Limited: Caps renovation costs at $35,000

- Standard: No set limit, but must fall within FHA mortgage limits for the area

VA Renovation Loans for Veterans

Veterans and active-duty service members can access VA renovation loans. These loans allow for home purchase and renovation or refinancing of an existing mortgage to fund improvements. VA loans often feature competitive interest rates and don’t require private mortgage insurance.

VA renovation loans can cover non-structural repairs. Borrowers must meet basic VA loan service requirements and have a valid Certificate of Eligibility. Credit score requirements vary by lender.

USDA Home Improvement Loans for Rural Areas

The U.S. Department of Agriculture provides loans and grants for home improvements in rural areas. The Section 504 Home Repair program offers:

- Loans up to $40,000

- Grants up to $10,000 for very low-income homeowners

These funds help repair, improve, or modernize homes.

Navigating Government Loan Options

Government-backed loans offer numerous benefits but come with specific requirements and limitations. Homeowners should review eligibility criteria, which often include:

- Income limits

- Property location restrictions

- Specific use of funds

Working with a lender experienced in government-backed loans proves crucial. These professionals guide you through the application process (often more complex than standard loan applications). They also help you understand the long-term implications of these loans, such as how they might affect your ability to sell or refinance in the future.

Comparing with Traditional Financing

While government loans provide unique opportunities, homeowners should compare them with traditional financing options. Factors to consider include:

- Interest rates

- Loan terms

- Eligibility requirements

- Long-term financial impact

This comparison ensures you choose the best fit for your specific situation and long-term financial goals.

Final Thoughts

Borrowing money for home renovations requires careful consideration of various options. Home equity loans, personal loans, and government-backed programs each offer unique benefits and drawbacks. We recommend you assess factors such as interest rates, loan terms, and eligibility requirements before making a decision.

Proper budgeting and planning are essential for successful renovations. Create a detailed budget that accounts for all aspects of the project, including a contingency fund of 10-20% to cover unforeseen expenses (this is often overlooked). Research local property values to ensure your renovations will add value to your home without overcapitalizing.

At Cameron Construction, we can help you plan your project effectively. Our team of experts provides tailored solutions that meet your specific needs and budget. With the right financing and careful planning, you can transform your home while making a sound investment in your property’s future.