Are Home Renovations Tax Deductible?

At Cameron Construction, we often hear homeowners ask, “Can home renovations be claimed on taxes?” It’s a common question that deserves a clear answer.

Home improvements can have significant tax implications, potentially leading to valuable deductions. In this post, we’ll explore which renovations may be tax-deductible and how to properly document your expenses for maximum benefits.

What Counts as Tax-Deductible Home Renovations?

Defining Tax-Deductible Expenses

Tax-deductible expenses reduce your taxable income, which lowers the amount of tax you owe. For home renovations, the Australian Taxation Office (ATO) classifies these expenses into two main categories: repairs and capital improvements.

Repairs vs. Capital Improvements

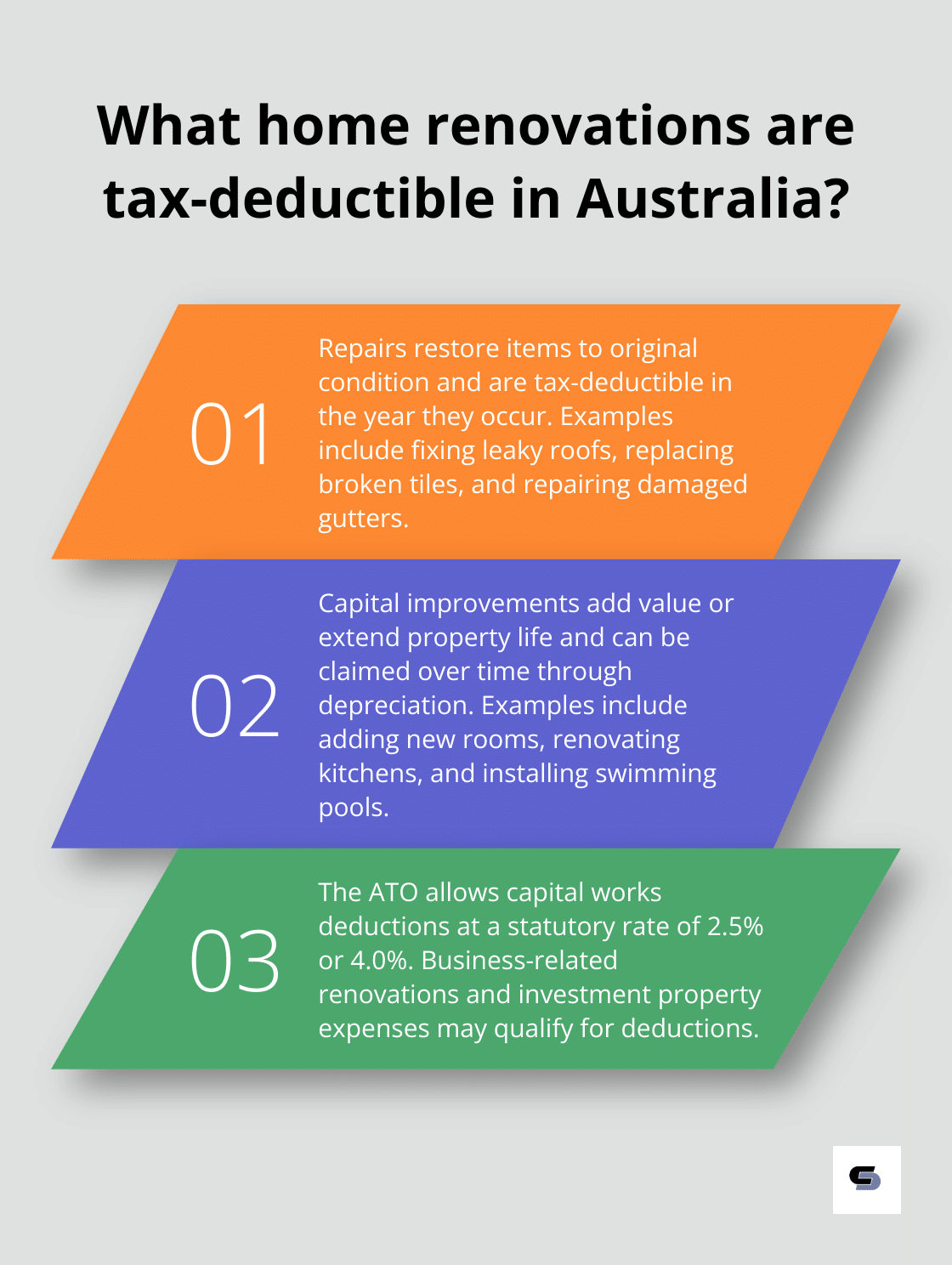

The ATO makes a clear distinction between repairs and capital improvements:

- Repairs: These restore something to its original condition and are tax-deductible in the year they occur. Examples include:

- Fixing a leaky roof

- Replacing broken tiles

- Repairing damaged gutters

- Capital Improvements: These add value to your property or extend its life. While not immediately deductible, you can claim them over time through depreciation. Examples include:

- Adding a new room

- Completely renovating a kitchen

- Installing a swimming pool

General Rules for Home Renovation Tax Deductions

Renovations on your primary residence typically don’t qualify for tax deductions. However, exceptions exist:

- Business Use: If you use part of your home for business purposes, renovations to that area might be deductible.

- Investment Properties: Many renovation expenses for investment properties can be claimed.

- Capital Works Deductions: The ATO allows deductions at the statutory rate of either 2.5% or 4.0%, whichever is applicable.

Record-Keeping for Tax Purposes

Maintaining detailed records of all renovation expenses is essential. Keep these documents:

- Receipts

- Invoices

- Contracts

These records are vital for claiming deductions and can prove invaluable during an ATO audit (which can happen at any time).

Seeking Professional Advice

Tax laws can be complex and change frequently. We recommend consulting with a tax professional before undertaking major renovations. They can provide personalized advice based on your specific situation and ensure you maximize your potential tax benefits while complying with ATO regulations.

Now that we’ve covered what counts as tax-deductible home renovations, let’s explore specific types of renovations that may qualify for tax deductions.

Which Renovations Qualify for Tax Deductions?

Home Office Renovations

Tax deductions for home office renovations apply when you use a part of your home exclusively for work. The Australian Taxation Office (ATO) allows claims for home-based business expenses if you operate some or all of your business from home. Eligible improvements include:

- Built-in shelving installation

- Lighting upgrades

- Additional electrical outlet installations

Energy-Efficient Upgrades

The Australian government offers incentives for certain energy-efficient home improvements. While not directly tax-deductible, these upgrades may qualify for rebates. For example, the WA Government is co-funding up to 50% of the cost of electric vehicle charger installations by eligible entities, with Round 3 open until 30 June 2025.

Medically Necessary Home Modifications

Home modifications required due to a medical condition or disability may qualify for tax deductions. To claim these expenses, you’ll need a doctor’s recommendation and detailed cost documentation. Eligible modifications can include:

- Ramp installations

- Doorway widening

- Handrail additions

Rental Property Renovations

For investment properties, many renovation expenses can be claimed on your taxes. This includes both repairs and improvements:

- Repairs (immediately deductible): Fixing a leaky roof, replacing broken tiles

- Capital improvements (depreciated over time): Kitchen remodels, bathroom upgrades

The ATO allows a 2.5% deduction per year for 40 years on these capital works.

Record-Keeping for Tax Purposes

Maintaining detailed records of all renovation expenses is essential for tax claims. Save these documents:

- Receipts

- Invoices

- Contracts

Consider using a digital expense tracking app to organize these documents efficiently (this can save you time and headaches during tax season).

Tax laws can be complex and subject to change. While this information provides a general overview, it’s always best to consult with a tax professional before undertaking major renovations. They can offer personalized advice to maximize your tax benefits while ensuring compliance with ATO regulations. Now, let’s explore how to effectively track and document your renovation expenses to ensure you don’t miss out on any potential tax deductions.

Master Renovation Expense Tracking

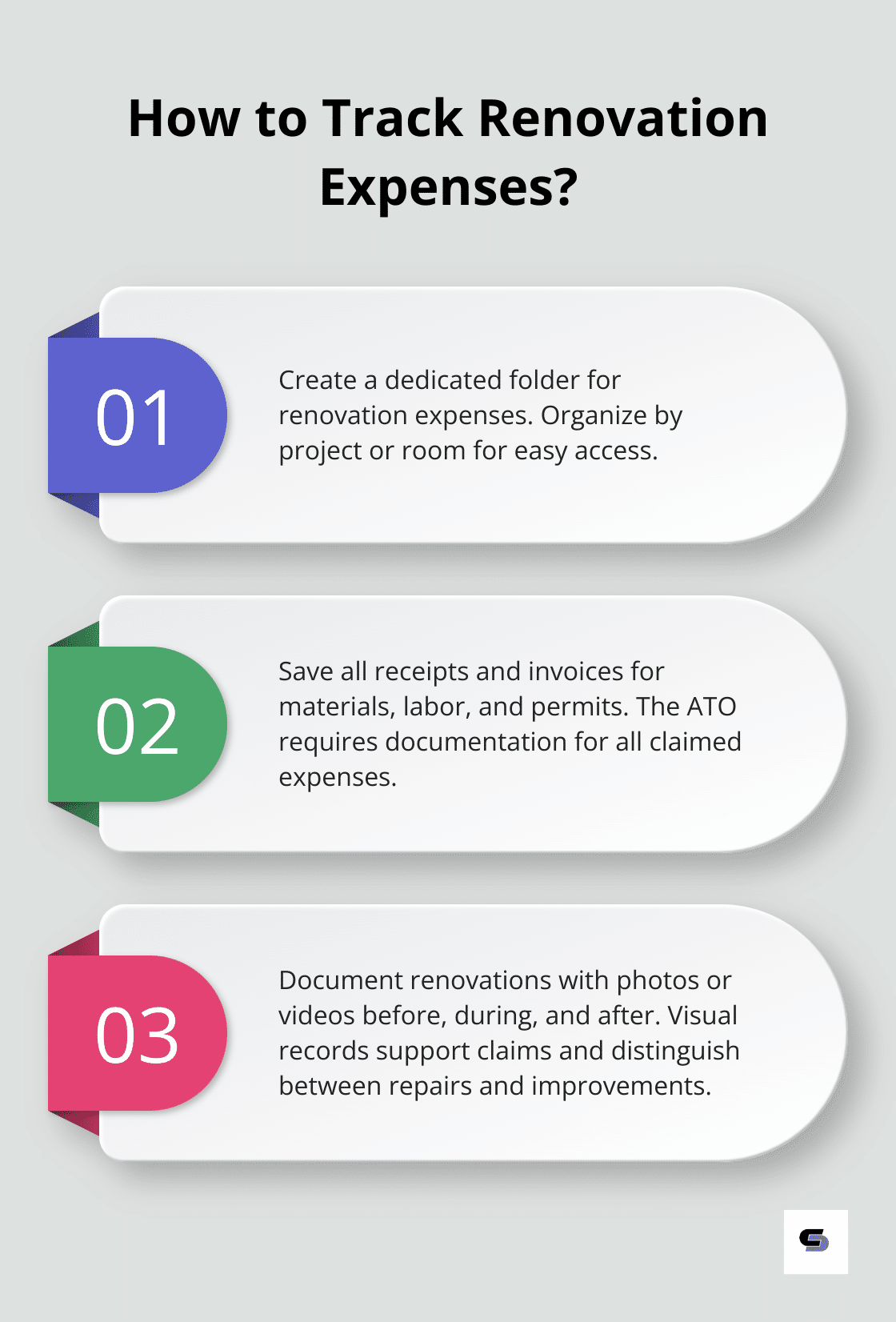

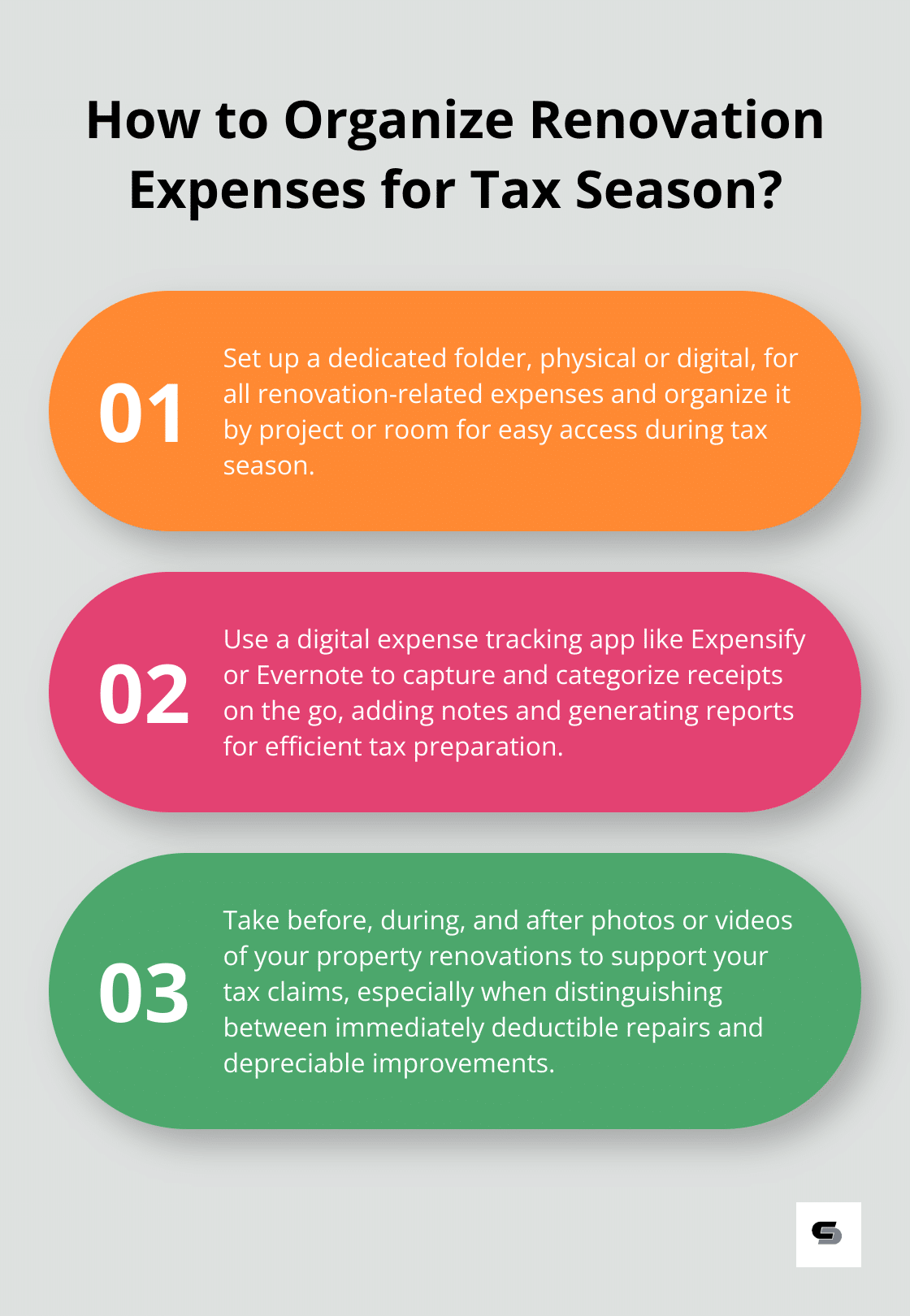

Create a Dedicated Renovation Expense File

Set up a specific folder for all renovation-related expenses. This can be a physical folder or a digital one on your computer. Organize it by project or room to locate specific expenses later with ease.

Save Every Receipt and Invoice

Keep all receipts and invoices related to your renovation project. This includes materials, labor costs, permits, and even smaller items like nails or paint brushes. The Australian Taxation Office (ATO) requires documentation for all claimed expenses, so no receipt is too small to save.

Document Before and After

Take photos or videos of your property before, during, and after renovations. These visual records can support your claims if the ATO questions the nature or extent of your renovations. They prove particularly useful for distinguishing between repairs (immediately deductible) and improvements (depreciated over time).

Use Digital Tools for Expense Tracking

Leverage technology to streamline your expense tracking. Apps like Expensify or Evernote help you capture and organize receipts on the go. Many of these tools allow you to categorize expenses, add notes, and generate reports – features that prove invaluable during tax preparation.

Maintain a Detailed Spreadsheet

Create a comprehensive spreadsheet that lists all renovation expenses. Include columns for the date, vendor, item description, cost, and tax category (repair vs. improvement). This overview will help you and your tax professional quickly assess your potential deductions.

The effort you put into tracking and documenting your renovation expenses can lead to significant tax savings. These strategies will prepare you to claim eligible deductions and navigate any potential ATO inquiries with confidence.

While diligent record-keeping is important, interpreting tax laws can be complex. We recommend working with a tax professional who specializes in property investments. They can guide you on what’s deductible, how to categorize expenses, and ensure you maximize your tax benefits within ATO guidelines.

Final Thoughts

Home renovations can significantly impact your tax situation. Certain improvements like home office upgrades, energy-efficient enhancements, and rental property renovations may qualify for tax deductions or credits. The rules surrounding these deductions are complex and subject to change, so it’s essential to consult with a qualified tax professional before undertaking major renovations.

Accurate record-keeping is paramount when you want to claim home renovations on taxes. Meticulous documentation of all costs, saving receipts, and organizing expenses will prepare you to support your claims if questioned by the Australian Taxation Office. This diligence can lead to substantial tax savings over time.

At Cameron Construction, we understand the importance of balancing aesthetic improvements with financial considerations. Our team specializes in creating tailored renovation solutions that transform your living space while considering potential tax implications. We strive to deliver high-quality renovations and extensions that align with your vision and financial goals.